In 2023, African businesses lost a staggering 9.4 billion to cybercrime - enough money to fund the entire annual healthcare budget of several African nations combined. As digital payments surge across the continent, a crucial question emerges: How can Africa's fintech pioneers protect millions of new digital consumers while fostering innovation?

The Nigerian fintech landscape stands at this critical intersection of growth and security. With mobile money transactions in Africa projected to exceed $1.5 trillion by 2025, payment providers face mounting pressure to fortify their systems against increasingly sophisticated cyber threats. In a recent interview on Arise News, Rowland Okondor, Head of Product at BudPay, one of Nigeria's fastest-growing payment solutions providers, shared insights into how African fintechs are building trust while combating emerging threats.

"The evolution of cyber threats demands a multi-layered defense strategy," explains Okondor. "We've established a comprehensive security framework that distributes responsibility across all stakeholders - from businesses and customers to acquirers and issuers. Our smart fraud detection system analyzes transaction patterns in real-time, monitoring payment instruments and locations to protect cardholders before fraud occurs."

The statistics paint a sobering picture of the challenge. Nigeria loses over ₦200 billion annually to cybercrime, encompassing both direct financial losses and devastating reputational damage to the financial sector. The Economic and Financial Crimes Commission (EFCC) has highlighted an urgent need for enhanced cybersecurity measures and youth training in cybercrime prevention. This escalating threat landscape has pushed African fintech companies to revolutionize their security approaches.

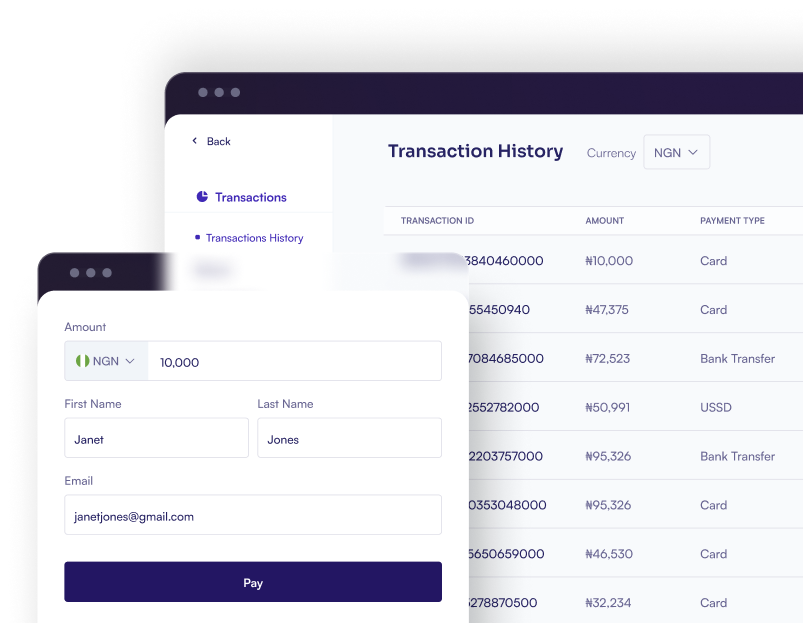

For BudPay, this innovation manifests in their implementation of 3D Secure (3DS) technology - a security protocol that creates three domains in transaction processing: the acquirer domain, the issuer domain, and the interoperability domain. This triple-layer verification system has proven crucial in preventing unauthorized transactions and protecting consumer data.

Small and medium enterprises (SMEs) face particular vulnerability in this landscape. With tightening margins due to economic pressures, many cannot afford robust internal security systems. BudPay's approach addresses this through their BudPay Business product, which integrates advanced security features with cost-effective solutions for smaller businesses. The platform's data analytics capabilities offer another security dimension. By processing payments from cards issued globally, BudPay accumulates valuable transaction intelligence. This data helps identify suspicious patterns and potential threats before they materialize into actual fraud attempts.

Looking ahead, the African fintech sector faces both opportunities and challenges. The integration of blockchain technology and AI-driven security solutions promises enhanced protection for digital transactions. However, the rapid evolution of cyber threats demands constant vigilance and innovation.

For Africa's digital payment ecosystem to thrive, security cannot be an afterthought. It must be woven into the very fabric of financial innovation. As Okondor and his team at BudPay demonstrate, the future of African fintech lies not just in facilitating transactions, but in building an impenetrable shield around them.