The tax landscape remains a daunting challenge for many in a country where 96% of businesses are SMEs, contributing nearly half of the GDP and employing 84% of Nigeria’s workforce. The stark reality is that most small business owners are navigating this complex terrain blindfolded. But what if embracing proper tax practices could do more than just meet government regulations? What if it could unlock growth opportunities, attract investors, and position your business for long-term success?

This realization hit home during the SME Clinic by BusinessDay, where Dr. Collins Igwe, the Chief Financial Officer of BudPay, joined a panel discussion that dissected the true cost of tax mismanagement and shared actionable strategies to transform the financial practices of SMEs.

A startling revelation from the session exposed a widespread practice among SMEs: using personal accounts for business transactions. This seemingly innocent habit is more costly than most realize. With Nigeria’s new tax regulations exempting businesses with turnover below ₦25 million from withholding tax starting January 2025, proper financial separation has never been more crucial. The implications ripple through every aspect of business growth, as banks hesitate to extend credit facilities without clear business financial records, while investors back away from businesses lacking financial transparency. “If you don’t have records, you allow the IRS to estimate what you owe,” warned Collins Igwe, highlighting how poor record-keeping puts businesses at the mercy of tax authorities.

While many view tax compliance as a burden, the cost of non-compliance far outweighs the investment in proper practices. Modern solutions like automated bookkeeping software and online invoicing platforms have made compliance more accessible than ever. For businesses experiencing rapid growth, implementing robust accounting software for accurate tracking and maintaining detailed transaction records becomes essential. Professional oversight through qualified accounting support can further strengthen this foundation.

With only 41 million formally registered businesses out of Nigeria’s vast SME landscape, proper tax practices set you apart in attracting investment. Clean financial records and tax compliance signal business maturity and reliability to potential investors. This financial transparency creates a clear pathway to growth opportunities that remain closed to businesses operating in the shadows of improper tax practices.

For SMEs operating internationally, the landscape becomes more complex. Different tax treaties, VAT regulations, and withholding tax laws require expert guidance to navigate successfully. This complexity shows the importance of establishing robust financial systems from the start, ensuring your business can adapt and grow across borders without stumbling over tax compliance issues.

Early planning emerged as a key theme during the session. As Dr. Igwe explained, taxes are inevitable, but businesses can legally optimize their tax obligations through proper planning. Starting early allows SMEs to structure their finances efficiently from day one, rather than scrambling to fix issues later. This proactive approach goes beyond mere compliance – it creates a strong financial foundation that supports business expansion. For Nigerian SMEs looking to grow, the message was clear: implementing proper tax practices isn’t optional, it’s essential to secure your company’s future growth and success.

Through expert insights and practical guidance, BudPay continues to illuminate the path forward for SMEs navigating Nigeria’s complex tax environment. By embracing proper tax practices today, businesses can position themselves for the opportunities of tomorrow.

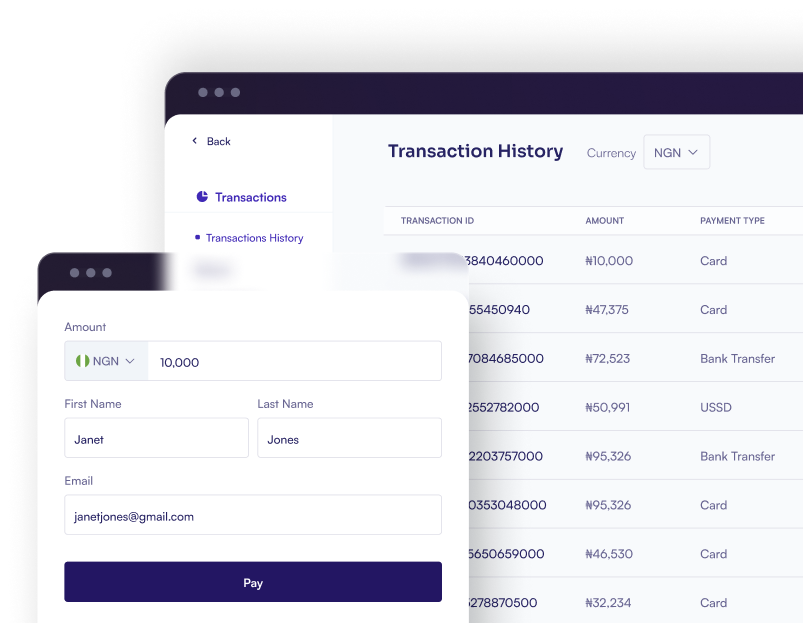

BudPay offers SMEs the tools they need to thrive in today’s digital economy. Through tailored payment solutions and financial management tools, the company is making it easier for businesses to maintain the proper financial practices discussed throughout the session. These solutions are designed to grow your business, ensuring you’re never held back by financial management challenges.

For SMEs ready to take control of their financial future and implement these crucial practices, exploring BudPay’s suite of solutions is a practical next step. The BudPay app and comprehensive service offerings at www.budpay.com provide the foundation needed to build a financially sound and compliant business in Nigeria’s dynamic market.