- What Is a Payment Gateway?

- What Is a Payment Processor?

- Payment Gateway vs Processor: Key Differences

- How Payment Gateways and Processors Work Together

- Features and Functions: Payment Gateway and Payment Processor

- Security and Compliance Responsibilities

- Is PayPal a Payment Gateway or Processor?

- Choosing the Right Solution for Your Business

- Frequently Asked Questions

- Conclusion: Optimizing Your Payment System

In the world of online transactions, understanding payment systems is crucial. Two key components are the payment gateway and the payment processor.

These terms are often used interchangeably, but they serve different roles. Knowing the difference can help businesses optimize their payment systems.

A payment gateway acts as a bridge between the customer and the merchant. It captures and transfers payment data securely.

On the other hand, a payment processor handles the logistics of the transaction. It ensures funds move from the customer’s account to the merchant’s account.

This guide will explore the differences between payment gateways and processors. It will help you choose the right solution for your business needs.

What Is a Payment Gateway?

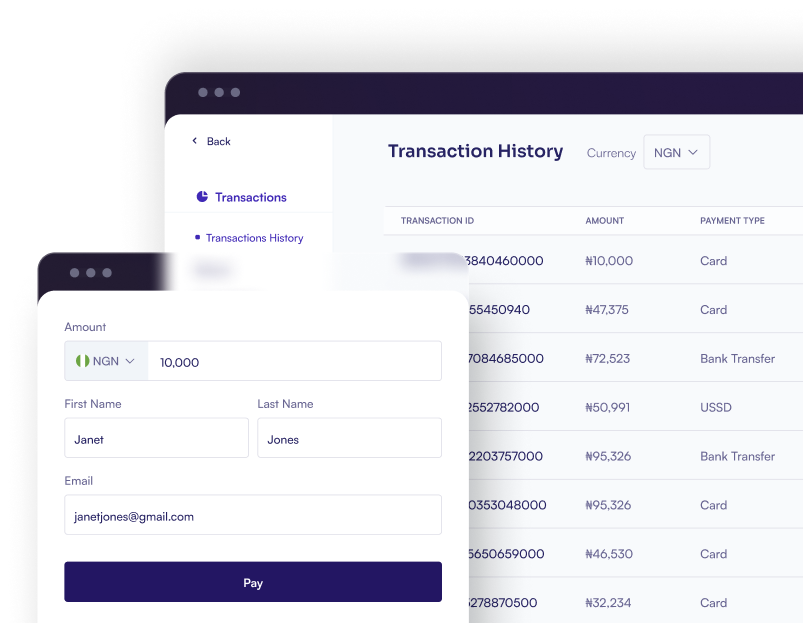

A payment gateway is essential for online transactions. It acts as a digital point-of-sale terminal. Its main role is to capture payment information.

The payment gateway ensures secure communication between the merchant and the customer. This involves encrypting sensitive data like credit card numbers. Thus, it protects customers from fraud.

Payment gateways do much more than just transfer data. They authorize transactions, checking the availability of funds. If funds are available, the transaction proceeds.

There are several features that enhance the utility of a payment gateway:

- Fraud detection mechanisms

- Data encryption and tokenization

- Support for multiple payment methods, such as credit cards, digital wallets, and bank transfers

The user interface is another key component. It provides a platform for customers to enter their payment information. Payment gateways can be either hosted or integrated. Hosted gateways redirect users to a third-party page, while integrated ones are embedded in the merchant’s site. Understanding these features helps businesses choose a suitable gateway.

What Is a Payment Processor?

A payment processor is the backbone of any transaction. It manages the details behind the scenes. This service handles the communication between the merchant’s bank and the customer’s bank.

Payment processors ensure that funds move accurately and efficiently. They perform crucial roles in transaction logistics. This includes fund transfers, settlements, and handling fees.

The list of processor functions is comprehensive:

- Managing transaction details

- Ensuring funds reach the right accounts

- Handling currency exchange and chargebacks

Security and compliance are vital in a payment processor’s role. They must protect sensitive data and adhere to financial standards. Many processors offer support for international transactions.

Processors also impact the speed of the transaction. Delays can frustrate customers, so fast service is a priority. They offer insights and analytics to improve business strategies.

In sum, payment processors are critical for the financial aspects of transactions. They ensure transactions conclude without errors and within the expected timeframe. This reliability keeps the e-commerce ecosystem running smoothly.

Payment Gateway vs Processor: Key Differences

Understanding the difference between a payment gateway and a processor is essential. Both play crucial roles, but their functions differ significantly. A payment gateway focuses on capturing and transferring payment data. In contrast, a processor handles executing the transaction itself.

A payment gateway primarily concerns the user interface and authorization of payments. It ensures customer data remains secure using encryption technologies. Additionally, gateways manage customer interactions during a transaction. This includes fraud detection and multiple payment method support.

Here’s what a payment gateway offers:

- Authorization and encryption

- Fraud detection and prevention

- User interface for payment entry

Meanwhile, a payment processor’s duty is transaction logistics. It communicates between banks and ensures funds transfer accurately. Processors handle currency conversion, chargebacks, and transaction settlements.

Key functions of a payment processor include:

- Fund transfer management

- Transaction settlement

- Currency conversion and chargeback handling

Despite their differences, both are vital for seamless online transactions. They work together to complete a transaction successfully. Their roles complement each other, ensuring customer satisfaction and smooth operation.

Choosing between them depends on specific business needs. Factors like transaction volume and security requirements matter. An integrated solution combining both can also be a viable option.

In conclusion, understanding these key differences helps businesses optimize their payment systems. This knowledge allows for informed decisions, influencing customer experience and business growth. Payment gateways and processors must coordinate effectively to drive online sales and foster customer trust.

How Payment Gateways and Processors Work Together

Payment gateways and processors form a crucial partnership. Despite distinct roles, their collaboration ensures smooth transactions. A payment gateway initiates the process by capturing payment details.

After authorization, the gateway sends this data to the payment processor. Here, the processor’s job is to liaise between banks. It ensures funds move securely from customer to merchant accounts.

This teamwork minimizes errors and maximizes efficiency. Each step requires precision, from data capture to fund settlement. Together, they handle complex operations effortlessly.

Here’s how they typically work together:

- Gateway captures and authorizes payment details.

- Processor receives data for fund transfer execution.

- Together, they complete transaction settlement smoothly.

For businesses, understanding their cooperation is key. It impacts both security and customer experience. Incorrect transactions can lead to customer dissatisfaction.

In essence, their partnership is the backbone of e-commerce. It ensures reliability, boosting business reputation and trust. Recognizing their synergy helps businesses optimize payment processes and improve overall operational efficiency.

Features and Functions: Payment Gateway and Payment Processor

Payment gateways and processors each have distinct features and functions. Understanding these can help businesses choose the right tools for their needs. Payment gateways primarily focus on frontend services.

They provide a seamless checkout experience for customers. Additionally, they enhance security with SSL encryption. Many gateways offer fraud detection, helping businesses safeguard customer data.

Key features of a payment gateway include:

- Secure data transfer via encryption

- User-friendly interfaces for payments

- Support for multiple payment methods

On the other hand, payment processors deal with backend operations. They ensure smooth communication between banks. Processors handle fund settlements and reconcile transactions.

Main functions of a payment processor are:

- Processing transactions and fund transfers

- Ensuring timely settlement into merchant accounts

- Managing chargebacks and disputes

Both systems offer analytics and reporting tools. These insights can be vital for business strategy. Utilizing these features effectively can optimize transaction processes.

Choosing the right combination of gateway and processor ensures a robust payment system. Businesses should evaluate which features align with their goals. This decision is critical for achieving operational excellence and enhancing customer satisfaction.

Security and Compliance Responsibilities

Security is paramount in payment processing. Payment gateways play a critical role in securing data during transactions. They employ encryption and other technologies to protect customer information.

Compliance with industry standards is essential. Both payment gateways and processors must adhere to regulations like PCI DSS. This ensures the protection of sensitive data and prevents fraud.

Key compliance and security responsibilities include:

- Encrypting transaction data

- Adhering to PCI DSS standards

- Implementing fraud detection mechanisms

Maintaining these security measures helps build customer trust. It also minimizes the risk of data breaches. Businesses should ensure their payment partners meet these compliance requirements. Doing so not only secures their operations but also reinforces their brand’s reputation in the market.

Is PayPal a Payment Gateway or Processor?

PayPal operates in a unique space, often serving as both a payment gateway and a processor. It simplifies transactions for millions of users worldwide. Businesses and consumers utilize PayPal for its convenience and flexibility.

PayPal’s dual functionality depends on the service it provides. As a payment gateway, it authorizes transactions and facilitates secure payments. As a processor, it manages the transfer of funds between buyer and seller accounts.

Here’s how PayPal functions in both roles:

- Payment Gateway: Authorizes and secures transactions.

- Payment Processor: Handles funds transfer and settlement.

This versatility makes PayPal a popular choice for many online merchants. It caters to diverse payment needs by combining gateway and processing services into one platform. This integration offers a seamless experience for users.

Choosing the Right Solution for Your Business

Selecting the appropriate payment solution is vital for e-commerce success. Both gateways and processors have unique advantages. Consider your business’s specific needs before making a choice.

Business size and transaction volume are key factors. Small businesses may opt for simple, cost-effective solutions. Larger enterprises might need advanced features and scalability.

Security is crucial for protecting customer data. Look for solutions with robust compliance standards. Ensure providers adhere to PCI DSS regulations.

Evaluate the user experience and checkout interface. A smooth payment process can boost conversion rates. Consider customizability and integration with your existing systems.

- Considerations:

- Transaction volume and business size

- Security and compliance standards

- Desired Features:

- Integration with e-commerce platforms

- Advanced analytics and reporting tools

Research various options to identify the best fit. Some companies offer integrated services that combine both gateway and processing functions. Ultimately, the right solution can enhance customer satisfaction and drive business growth.

Frequently Asked Questions

What is the main difference between a payment gateway and a payment processor?

A payment gateway handles the authorization and secure transmission of payment data. In contrast, a payment processor manages the actual transaction by facilitating communication between financial institutions.

Are payment gateways necessary for online transactions?

Yes, gateways provide a secure platform for processing payment information. They are essential for online sales and fraud protection.

Does my business need both a payment gateway and a processor?

Typically, both are necessary for online transactions. Some providers offer combined solutions to streamline the process.

Conclusion: Optimizing Your Payment System

Understanding the difference between payment gateways and processors is key to enhancing your e-commerce operations. By selecting the right solution, you can improve checkout experiences and ensure secure transactions.

Evaluate your business needs and goals when choosing a payment system. The right payment strategy can boost customer satisfaction and drive growth, providing both reliability and security in every transaction.