- Understanding the Migration Timeline

- Key Technical Considerations

- API Integration and Documentation

- Data Migration

- Financial and Operational Impacts

- Transaction Fee Structures

- Accounting and Reconciliation Changes

- Minimizing Customer Impact

- Risk Management During Transition

- Legal and Compliance Considerations

- Post-Migration Optimization

- Ready to Transform Your Payment Operations?

The way businesses exchange value has evolved and a payment processing system is the heartbeat of any business operations. You may be considering making changes to how your organisation processes payments. Whether you’re seeking lower transaction fees, better customer support, enhanced security features, or more robust APIs, your reasons are valid. Switching payment processors is sometimes necessary for growth.

However, many business leaders hesitate to make the change, fearing disruption to their cash flow or technical complications. The good news? With proper planning and understanding, migrating to a new payment processor like BudPay can be far smoother than you might expect. This guide walks you through what to anticipate and how to ensure a seamless transition.

Understanding the Migration Timeline

A complete payment processor migration typically spans 4-8 weeks, depending on your business complexity and transaction volume. Breaking this down into phases helps make the process manageable:

Phase 1: Assessment and Planning (1-2 weeks) During this initial phase, you’ll evaluate your current payment workflows, document integration points, and identify specific requirements for your new processor. This groundwork sets the stage for a successful migration.

Phase 2: Technical Integration (2-3 weeks) This is where your development team implements the new payment gateway’s APIs, updates checkout flows, and begins parallel testing to ensure everything functions correctly before going live.

Phase 3: Testing and Validation (1-2 weeks) Comprehensive testing across different payment scenarios, transaction types, and edge cases ensures that your new system works flawlessly before affecting real customers.

Phase 4: Rollout and Monitoring (1 week) The final phase involves gradually shifting transaction volume to your new processor while closely monitoring for any issues that might arise.

Key Technical Considerations

API Integration and Documentation

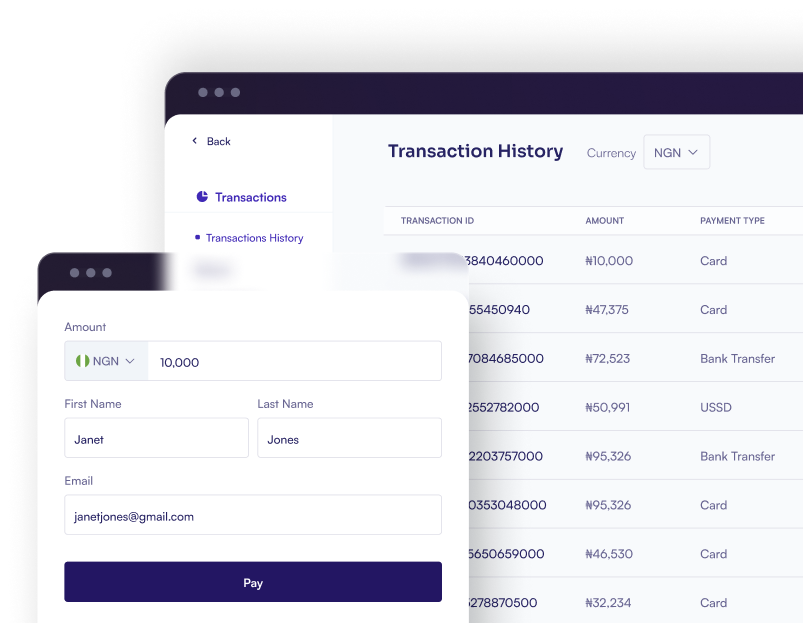

When switching to a new payment processor, the quality of their API documentation becomes crucial. BudPay’s developer-friendly API documentation includes code samples in multiple programming languages, making integration significantly easier. Their RESTful API architecture follows industry standards, allowing for a more intuitive implementation process.

The technical aspects to focus on include:

- Authentication mechanisms: Understanding how to securely authenticate API requests

- Webhook implementation: Setting up proper notification systems for transaction events

- Error handling: Implementing robust error handling to gracefully manage failed transactions

- Testing environment: Utilizing sandbox environments to validate integration before going live

Data Migration

One common concern when switching payment processors is how to handle existing customer payment data. There are three main approaches:

- Gradual migration: New customers use the new processor while existing customers remain on the old system until their next renewal or payment cycle

- Card-on-file migration: Using a PCI-compliant token migration service to transfer saved payment methods

- Customer re-entry: Requesting customers to update their payment information (typically the least preferred option)

BudPay offers secure token migration services that allow you to transfer saved payment methods without requiring customers to re-enter their information, providing a frictionless experience during the transition.

Financial and Operational Impacts

Transaction Fee Structures

Understanding the fee structure of your new payment processor is essential for accurate financial forecasting. Traditional processors often employ a complex fee structure with:

- Base transaction fees

- Interchange fees

- Assessment fees

- Monthly statement fees

- Gateway fees

- Chargeback fees

BudPay simplifies this with transparent pricing models, helping you predict costs more accurately and potentially saving 0.5-1.5% on total processing fees compared to other providers.

Accounting and Reconciliation Changes

Your finance team will need to prepare for changes in:

- Settlement timing (how quickly funds reach your bank account)

- Reporting formats and data exports

- Reconciliation processes

- Financial dashboards and analytics

Many businesses find that modern processors like BudPay actually simplify reconciliation with more detailed reporting and real-time transaction data, ultimately reducing the accounting department’s workload.

Minimizing Customer Impact

The goal of any payment processor migration should be complete invisibility to your customers. To achieve this:

- Maintain consistent branding: Ensure checkout experiences look and feel identical

- Avoid double charges: Implement safeguards against duplicate transactions during the migration period

- Prepare customer support: Train your team to handle any payment-related questions that might arise

- Monitor decline rates: Watch closely for any unusual patterns in transaction approval rates

BudPay’s seamless checkout integration tools allow you to maintain your existing customer experience while benefiting from enhanced backend capabilities.

Risk Management During Transition

Every systems change involves some level of risk. Mitigate these concerns by:

- Starting with a small percentage: Begin by routing just 5-10% of transactions through your new processor

- Creating a rollback plan: Document exactly how you’ll revert to your previous system if needed

- Monitoring key metrics: Track authorization rates, transaction success rates, and processing times

- Scheduling the migration during lower-volume periods: Avoid peak business seasons or high-traffic events

Legal and Compliance Considerations

Payment processing is subject to numerous regulations including PCI DSS, GDPR (in Europe), and various local financial laws. Your new processor should help navigate these requirements, but you’ll need to:

- Update your terms of service and privacy policy

- Ensure proper data handling practices are maintained during migration

- Review contracts for any notification requirements to your existing processor

BudPay’s compliance team can provide guidance specific to your industry and region, helping ensure your migration adheres to all relevant regulations.

Post-Migration Optimization

Once your migration is complete, the real benefits begin. Modern payment processors offer analytics and optimization tools that can help you:

- Identify and reduce transaction failures

- Implement smart routing to increase approval rates

- Deploy machine learning tools to detect and prevent fraud

- Access detailed reports on payment performance

Many businesses discover that these capabilities provide unexpected revenue lifts of 3-5% after migration, simply through improved payment operations.

Ready to Transform Your Payment Operations?

Switching payment processors is an opportunity to modernize your entire payment infrastructure and improve your bottom line. With BudPay’s industry-leading payment gateway and robust API suite, you can transform payment processing from a business necessity into a strategic advantage.

Our dedicated migration specialists will guide you through each step of the transition process, ensuring minimal disruption to your operations while maximizing the benefits of our advanced payment technology.

Visit BudPay.com to start your seamless payment processor migration journey.