- Understanding Legacy Planning in Business

- The Role of Technology in Business Transitions

- 1. Digital Documentation and Smart Contracts

- 2. Data-Driven Decision Making

- 3. Cybersecurity and Asset Protection

- 4. Knowledge Transfer Through Digital Platforms

- 5. Financial and Estate Planning Automation

- 5. Transitioning from Traditional Payment Methods to Digitised Payments

- Final Thoughts: Tech-Enabled Business Legacy Planning

Every successful business reaches a point where its leaders must think about the future. What happens when they step down, retire, or pass on their legacy? Legacy planning ensures that a business continues to thrive through transitions, whether from one generation to another or through changes in ownership and leadership.

Thanks to technology, these transitions can be smoother, more efficient, and sustainable. This article expands on legacy management and why every business should start planning on time.

Understanding Legacy Planning in Business

Legacy planning is a strategic process that ensures the long-term survival and growth of a business by preparing for leadership and ownership transitions. It involves identifying successors, structuring financial and operational continuity, and safeguarding the company’s core values. Nigerian businesses that neglect legacy planning often face disruptions, loss of vision, and financial instability when leadership changes unexpectedly.

Traditionally, legacy planning relied on legal documentation, financial strategies, and human resource planning. However, the rapid evolution of technology has introduced tools that streamline these processes, enhance transparency, and reduce risks associated with transitions.

The Role of Technology in Business Transitions

Technology has revolutionized legacy planning in several key ways, making it easier for businesses to transfer knowledge, maintain continuity, and secure assets. Here are some of the ways technology contributes to a successful business transition:

1. Digital Documentation and Smart Contracts

One of the biggest challenges in business succession is ensuring that all necessary documents such as wills, shareholder agreements, and operational procedures are accessible and up to date. Cloud storage and digital documentation tools enable business owners to securely store, share, and update important legal and financial documents in real time. In Nigeria, businesses can leverage platforms like Google Drive, OneDrive, and blockchain-based smart contracts to automate agreements and ensure smooth succession planning.

2. Data-Driven Decision Making

Successful business transitions rely on accurate data. Technology provides analytical tools to assess company performance, market trends, and employee productivity. In business transitions, it’s crucial to gather and align all data, analyze it, and present it in a way that is useful to the business. Using well-processed data can help business owners make informed decisions about succession planning, investments, and risk management.

3. Cybersecurity and Asset Protection

As Nigerian businesses shift to digital platforms, cybersecurity becomes a critical component of legacy planning. Sensitive business data, customer information, and intellectual property must be protected from cyber threats. Implementing strong cybersecurity measures, such as encrypted databases and multi-factor authentication, ensures that the business remains secure during transitions and prevents fraud or data breaches that could destabilize operations.

4. Knowledge Transfer Through Digital Platforms

One of the biggest risks in leadership transition is the loss of institutional knowledge. Digital knowledge management systems, such as intranets, wikis, and cloud-based collaboration tools, can help businesses to document processes, record best practices, and ensure that new leaders have access to historical data and insights. Virtual mentorship programs and coaching platforms further facilitate seamless knowledge transfer between outgoing and incoming leadership teams.

5. Financial and Estate Planning Automation

Legacy planning involves financial structuring, including estate planning, tax strategies, and investment management. Investment houses offer tools for wealth management, asset tracking, and tax optimization. Financial advisors can assist business owners in making sound investment decisions to preserve wealth for future generations.

5. Transitioning from Traditional Payment Methods to Digitised Payments

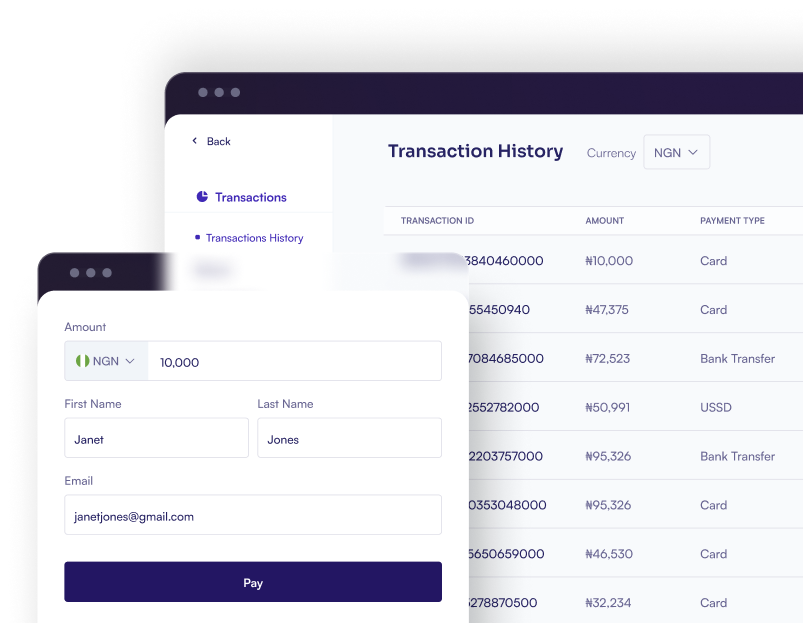

Make digital payments a priority in Nigeria when planning for business succession. It starts with replacing cash-based systems with online payment collections and payouts. These will enable tracking that can help reduce fraud risk and operational inefficiency. This technology shift not only appeals to younger, tech-savvy consumers but also provides greater financial visibility and accountability during leadership transitions. Embrace digital payment infrastructure as both a practical necessity and a strategic advantage for ensuring your business remains competitive in Nigeria’s increasingly digital marketplace.

Final Thoughts: Tech-Enabled Business Legacy Planning

Technology is no longer a luxury but a necessity in legacy planning. As a business owner, embracing digital solutions can ensure smoother transitions, maintain operational stability, and protect legacies for future generations.

With legacy planning aligns with technology, you can not only future-proof operations but also empower successors with the tools needed to sustain and grow the company you’ve built over the years.