- Why Expand Across Africa?

- Nigeria

- Requirements

- Process

- Estimated Costs

- Ghana

- Requirements

- Process

- Estimated Costs

- Special Considerations

- Kenya

- Requirements

- Process

- Estimated Costs

- Special Considerations

- South Africa

- Requirements

- Process

- Estimated Costs

- Special Considerations

- Read more: 5 Signs Your Business Is Ready for International Expansion Across Africa

- Seamless Cross-Border Operations with BudPay

- Ready to Expand Your Business Across Africa?

As African economies continue to integrate and digital barriers fall, expanding your Nigerian business into neighboring markets has never been more strategic. With a total GDP of $3.4 trillion and a population exceeding 1.3 billion, the African continent offers a huge growth opportunity for ambitious Nigerian entrepreneurs.

This guide provides detailed, country-specific registration requirements for four key African economies: Nigeria (for reference), Ghana, Kenya, and South Africa. These markets represent strategic entry points into West, East, and Southern Africa with a combined consumer base of over 260 million people.

Why Expand Across Africa?

Recent data from the African Development Bank shows intra-African trade increased by 18% in 2023, signaling growing commercial integration. Also many initiatives across trade blocks are also helping to gradually remove barriers to cross-border commerce, creating unprecedented opportunities for businesses looking to scale beyond their home markets.

Nigerian businesses specifically have compelling reasons to expand:

- Diversify revenue streams: Reduce dependence on Nigeria’s economic cycles

- Access new consumer bases: Tap into markets with different needs and preferences

- Leverage regional advantages: Benefit from various trade agreements and incentives

- Scale operations: Achieve economies of scale through multi-market presence

Nigeria

Requirements

- Business name reservation with Corporate Affairs Commission (CAC)

- Minimum share capital (₦100,000 for private companies)

- Memorandum and Articles of Association

- Identification documents for all directors and shareholders

- Registered office address

Process

- Reserve company name on CAC portal (1-3 days)

- Prepare and submit incorporation documents (7-10 days)

- Obtain Tax Identification Number (TIN) from FIRS

- Register for VAT if applicable

- Open corporate bank account

Estimated Costs

- Name reservation: ₦5,000

- Registration fees: ₦15,000 – ₦60,000 (depending on share capital)

- Professional fees: ₦50,000 – ₦150,000

Ghana

Requirements

- Business name reservation with Registrar of Companies

- Minimum capital: $1,000,000 for foreign-owned entities (can be reduced to $500,000 for joint ventures with Ghanaian partners)

- Company regulations (equivalent to Articles of Association)

- Tax Clearance Certificate from home country

- Proof of foreign investment capital transferred through Ghanaian banking system

Process

- Reserve company name with Registrar-General’s Department (2-3 days)

- Prepare and submit incorporation documents (5-7 days)

- Register with Ghana Investment Promotion Centre (GIPC) – mandatory for foreign businesses

- Obtain Tax Identification Number from Ghana Revenue Authority

- Register for VAT if annual turnover exceeds GHC 200,000

- Apply for necessary permits depending on industry

- Open corporate bank account

Estimated Costs

- Name reservation: GHC 50-100

- Registration fees: GHC 230-500

- GIPC registration: $2,500 annual renewal fee

- Professional fees: $1,000-$3,000

Special Considerations

- Ghana requires proof that foreign investment capital has been brought into the country

- Certain sectors (retail, fishing, mining) have additional restrictions and requirements

- Annual renewal with GIPC is mandatory to maintain compliance

Kenya

Requirements

- Business name reservation with Registrar of Companies

- Minimum share capital: KSh 100,000

- Articles of Association

- Copy of passport or ID for all directors and shareholders

- KRA PIN (tax identification) for all directors and shareholders

- Registered physical address in Kenya

Process

- Reserve company name on eCitizen portal (1-2 days)

- Prepare and submit incorporation documents through eCitizen (3-5 days)

- Obtain KRA PIN for the company

- Register for VAT if annual turnover exceeds KSh 5 million

- Register with National Social Security Fund (NSSF)

- Register with National Hospital Insurance Fund (NHIF)

- Apply for business permits from county governments

- Open corporate bank account

Estimated Costs

- Name reservation: KSh 150

- Registration fees: KSh 10,650

- Business permit: KSh 10,000-50,000 (varies by county and business type)

- Professional fees: KSh 40,000-80,000

Special Considerations

- Kenya’s Business Laws Amendment Act 2020 has simplified several processes

- Foreign companies must have at least 30% Kenyan ownership in certain protected sectors

- Digital service tax of 1.5% applies to online businesses

South Africa

Requirements

- Business name reservation with Companies and Intellectual Property Commission (CIPC)

- Memorandum of Incorporation

- Minimum of one director

- Registered address in South Africa

- Appointment of auditor for certain company types

- Bank account with a minimum deposit of ZAR 50,000 for business visa applications

Process

- Reserve company name with CIPC (3-5 days)

- Register company with CIPC (7-10 days)

- Register with South African Revenue Service (SARS)

- Register for VAT if annual turnover exceeds ZAR 1 million

- Register with Unemployment Insurance Fund (UIF)

- Register with the Department of Labour for Compensation Fund

- Apply for business licenses specific to your industry

- Open corporate bank account

Estimated Costs

- Name reservation: ZAR 50

- Registration fees: ZAR 125 (private company)

- Professional fees: ZAR 2,500-5,000

- Business licenses: Varies by industry

Special Considerations

- B-BBEE (Broad-Based Black Economic Empowerment) compliance is important for government contracts

- Certain sectors require minimum 51% South African ownership

- Work permits for non-South African directors can be complex to obtain

Read more: 5 Signs Your Business Is Ready for International Expansion Across Africa

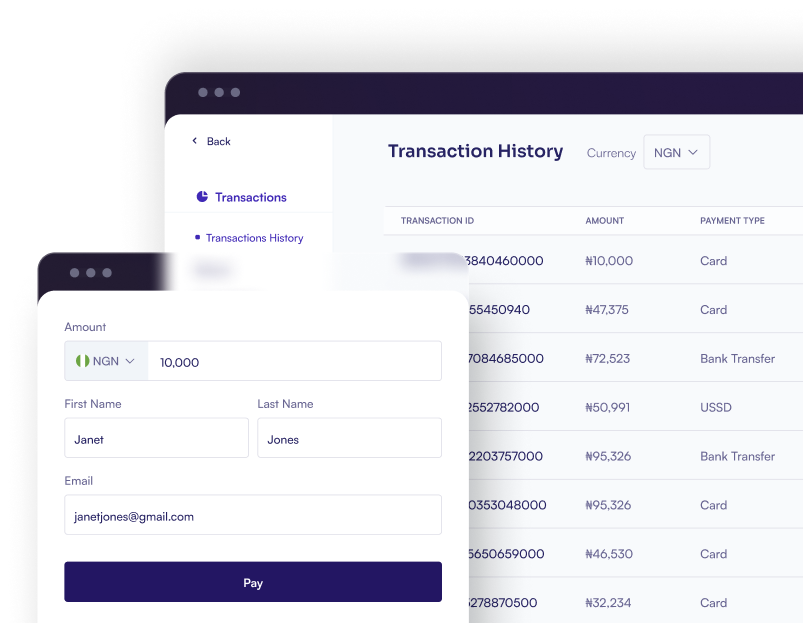

Seamless Cross-Border Operations with BudPay

Business registration is just the first step. Successfully operating across multiple African markets requires seamless payment infrastructure. BudPay offers comprehensive payment solutions designed specifically for businesses expanding across Africa:

- Accept payments in local currencies: Collect payments from customers in Ghana Cedis, Kenyan Shillings, South African Rand, and other African currencies

- Instant settlement options: Access your funds quickly in preferred currency

- Single API integration: Connect once to access payment methods across all markets

- Compliance built-in: Meet regulatory requirements across multiple jurisdictions

- Reduced forex exposure: Minimize currency conversion costs and risks

- Detailed analytics: Track performance across all your African markets

Ready to Expand Your Business Across Africa?

Expanding across borders represents both significant opportunity and considerable challenge. With BudPay’s pan-African payment infrastructure, you can focus on growing your business while we handle the complexities of multiple currencies and cross-border payment.

Sign up on BudPay today and unlock access to our comprehensive cross-border payment solutions. Our team of Africa expansion specialists can guide you through optimizing your payment strategy for each market.

Visit BudPay.com to schedule a discovery call or sign up directly. Your pan-African business journey starts here.