- 1. What types of taxes do businesses in Nigeria pay?

- 2. Who is required to pay taxes in Nigeria?

- 3. How do I register my business for tax purposes?

- 4. What is Company Income Tax (CIT), and how much is it?

- 5. What is Value Added Tax (VAT), and who should pay it?

- 6. How do I file my taxes in Nigeria?

- 7. What is Withholding Tax (WHT), and how does it work?

- 8. Do small businesses need to pay taxes?

- 9. How often do businesses need to file VAT returns?

- 10. What happens if I fail to pay my taxes?

- 11. Are there tax incentives for businesses in Nigeria?

- 12. Can I claim tax refunds in Nigeria?

- 13. What is Tertiary Education Tax (TET)?

- 14. Is there a tax on digital services?

- 15. What is PAYE tax, and who is responsible for it?

- 16. What tax obligations do sole proprietors have?

- 17. How do I calculate my business tax liability?

- 18. Are online businesses required to pay tax?

- 19. How can I avoid tax penalties?

- 20. What records should I keep for tax purposes?

- 21. Can I pay my taxes online?

- 22. What happens if my business is dormant?

- 23. How does tax apply to expatriate employees?

- 24. Do religious or non-profit organizations pay taxes?

- 25. Can I claim business expenses as tax deductions?

- 26. What is Stamp Duty, and who pays it?

- 27. What tax applies to dividends?

- 28. How does the government enforce tax compliance?

- 29. Can my business operate without a TIN?

- 30. Are freelancers required to pay tax?

- 31. What tax applies to property rentals?

- 32. How do I update my business tax details?

- 33. Are there tax exemptions for startups?

- 34. How can I dispute a tax assessment?

- 35. What is an annual tax clearance certificate?

- 36. What tax applies to capital gains?

- 37. Are agricultural businesses taxed?

- 38. What is the role of state tax authorities?

- 39. How do I stay updated on tax regulations?

- 40. Can BudPay help with tax compliance?

- Take Control of Your Business Taxes Today!

Understanding how taxes work as a Nigerian Business owner is necessary for staying compliant and avoiding unnecessary penalties. If you’ve ever found yourself confused about tax obligations, you’re not alone. In this guide, we’ll answer 40 common questions about Nigerian business taxes to help you navigate the system confidently.

1. What types of taxes do businesses in Nigeria pay?

Businesses in Nigeria pay several taxes, including Company Income Tax (CIT), Value Added Tax (VAT), Personal Income Tax (PIT) (for employees), Withholding Tax (WHT), and Tertiary Education Tax (TET), among others.

2. Who is required to pay taxes in Nigeria?

All registered businesses, whether small enterprises, limited liability companies, or sole proprietorships, are required to pay taxes.

3. How do I register my business for tax purposes?

You need to register with the Federal Inland Revenue Service (FIRS) and obtain a Tax Identification Number (TIN). This can be done online via the Joint Tax Board website or by visiting a tax office.

4. What is Company Income Tax (CIT), and how much is it?

CIT is a tax on the profits of registered companies in Nigeria. The rate depends on the company’s revenue:

- Small businesses (below ₦25 million annual turnover) – 0%

- Medium businesses (₦25 million – ₦100 million turnover) – 20%

- Large businesses (above ₦100 million turnover) – 30%

5. What is Value Added Tax (VAT), and who should pay it?

VAT is a 7.5% tax applied to the sale of goods and services. Businesses with an annual turnover of ₦25 million and above must charge VAT and remit it to FIRS.

6. How do I file my taxes in Nigeria?

You can file taxes through the FIRS e-Tax platform or visit a tax office to submit your returns.

7. What is Withholding Tax (WHT), and how does it work?

WHT is an advance payment of tax deducted at the source when making payments for services, contracts, or dividends. Rates vary between 5%-10% depending on the transaction.

8. Do small businesses need to pay taxes?

Yes, but small businesses with an annual turnover below ₦25 million are exempt from CIT. However, they must comply with VAT and other tax obligations.

9. How often do businesses need to file VAT returns?

VAT returns must be filed monthly, on or before the 21st of the following month.

10. What happens if I fail to pay my taxes?

Failure to pay taxes can result in penalties, interest charges, or legal action by FIRS.

11. Are there tax incentives for businesses in Nigeria?

Yes, businesses in priority sectors (e.g., agriculture, manufacturing, and export) may qualify for tax holidays under the Pioneer Status Incentive.

12. Can I claim tax refunds in Nigeria?

Yes, if you overpay taxes, you can apply for a refund from FIRS, but the process can take time.

13. What is Tertiary Education Tax (TET)?

TET is a 2.5% tax on the assessable profit of registered companies, used to fund higher education institutions in Nigeria.

14. Is there a tax on digital services?

Yes, non-resident digital service providers (e.g., streaming platforms, SaaS companies) must pay 6% VAT on their services in Nigeria.

15. What is PAYE tax, and who is responsible for it?

PAYE (Pay As You Earn) is a tax deducted from employees’ salaries by employers and remitted to the state tax authority.

16. What tax obligations do sole proprietors have?

Sole proprietors must pay Personal Income Tax (PIT) instead of CIT, with rates ranging from 7%-24%.

17. How do I calculate my business tax liability?

Tax liability depends on your business structure, turnover, and applicable tax rates. Consult a tax professional who can help ensure accurate calculations.

18. Are online businesses required to pay tax?

Yes, online businesses must comply with VAT, CIT (if registered as a company), and other tax obligations.

19. How can I avoid tax penalties?

File your tax returns on time, keep accurate records, and comply with all tax laws.

20. What records should I keep for tax purposes?

Invoices, receipts, payroll records, bank statements, and tax returns should be kept for at least six years.

21. Can I pay my taxes online?

Yes, through the FIRS online portal (or state equivalents) as well as designated bank payment platforms.

22. What happens if my business is dormant?

You must still file tax returns to notify FIRS (or state equivalents) of your inactivity to avoid penalties.

23. How does tax apply to expatriate employees?

Expatriates working in Nigeria for over 183 days in a year must pay Personal Income Tax (PIT).

24. Do religious or non-profit organizations pay taxes?

They are generally exempt from CIT but may be liable for VAT and WHT.

25. Can I claim business expenses as tax deductions?

Yes, expenses like rent, salaries, and utilities are deductible from taxable income.

26. What is Stamp Duty, and who pays it?

Stamp Duty applies to transactions such as leases, loans, and share transfers.

27. What tax applies to dividends?

A 10% withholding tax is deducted on dividends paid to shareholders.

28. How does the government enforce tax compliance?

FIRS conducts audits, penalties, and prosecutions for non-compliance.

29. Can my business operate without a TIN?

No, a TIN is required for tax filing and most official transactions.

30. Are freelancers required to pay tax?

Yes, freelancers must pay PIT and VAT if their revenue exceeds ₦25 million.

31. What tax applies to property rentals?

A 10% WHT applies to rental income.

32. How do I update my business tax details?

Visit an FIRS office or update records online.

33. Are there tax exemptions for startups?

Yes, businesses under Pioneer Status enjoy tax holidays.

34. How can I dispute a tax assessment?

File an objection with FIRS within 30 days of assessment.

35. What is an annual tax clearance certificate?

A certificate showing a business has met all tax obligations.

36. What tax applies to capital gains?

A 10% tax is charged on profits from asset sales.

37. Are agricultural businesses taxed?

They enjoy some exemptions and incentives.

38. What is the role of state tax authorities?

They handle PAYE and PIT for individuals and businesses.

39. How do I stay updated on tax regulations?

Follow FIRS announcements and consult tax professionals.

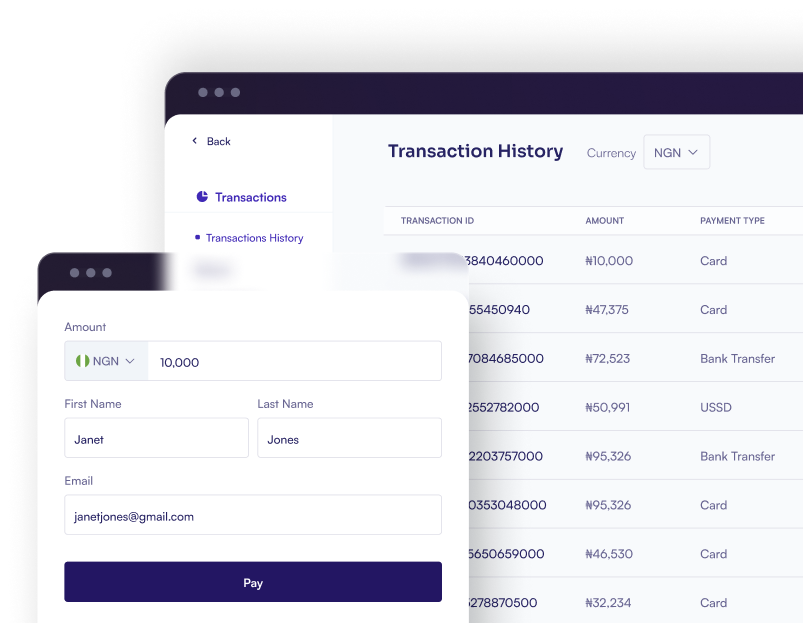

40. Can BudPay help with tax compliance?

Yes! BudPay provides transaction history and other meta data that can be useful during tax filings and audits.

Take Control of Your Business Taxes Today!

Managing business taxes doesn’t have to be complicated. With the right knowledge and tools, you can ensure compliance and focus on growing your business. Sign up on BudPay today and simplify your tax payments with ease!