- What Is Bud Infrastructure Limited?

- What Services Does BudPay (Bud Infrastructure) Provide?

- Is There a BudPay (Bud Infrastructure Limited) App?

- Bud Infrastructure Limited and Parallex Bank

- What Is TPT and Why Is It Important?

- Who Owns Bud Infrastructure Limited?

- Salary Information: Working at Bud Infrastructure Limited

- FAQs About Bud Infrastructure Limited

- Conclusion: Why Bud Infrastructure Matters

At BudPay, we understand how critical infrastructure is to powering seamless, secure, and compliant payments in Nigeria and across Africa. One name that has generated increasing interest online in recent months is Bud Infrastructure Limited. We’d like to offer clarity, particularly for those searching for terms like:

- Bud infrastructure

- Bud infrastructure limited app download

- Bud infrastructure limited login

- Bud infrastructure limited parallex bank

In this article, we’ll explain what BudPay (Bud Infrastructure Limited) does, what it means to be a Payment Solutions Service Provider (PSSP) in Nigeria, and why this entity matters for fintechs, aggregators, and businesses looking to build on reliable payment rails.

What Is Bud Infrastructure Limited?

Bud Infrastructure Limited is the parent company of BudPay, a registered financial technology infrastructure provider in Nigeria, focused on enabling core payment processing, third-party transfers (TPT), and merchant onboarding. As a CBN-licensed PSSP and IMTO, BudPay (Bud Infrastructure Limited) provides the backend capabilities that allow payment platforms and other fintechs to operate efficiently, compliantly, and at scale.

When you hear Bud Infrastructure, Bud Infrastructure Ltd, or Bud Fintech, it’s often about referring to the same entity.

What Services Does BudPay (Bud Infrastructure) Provide?

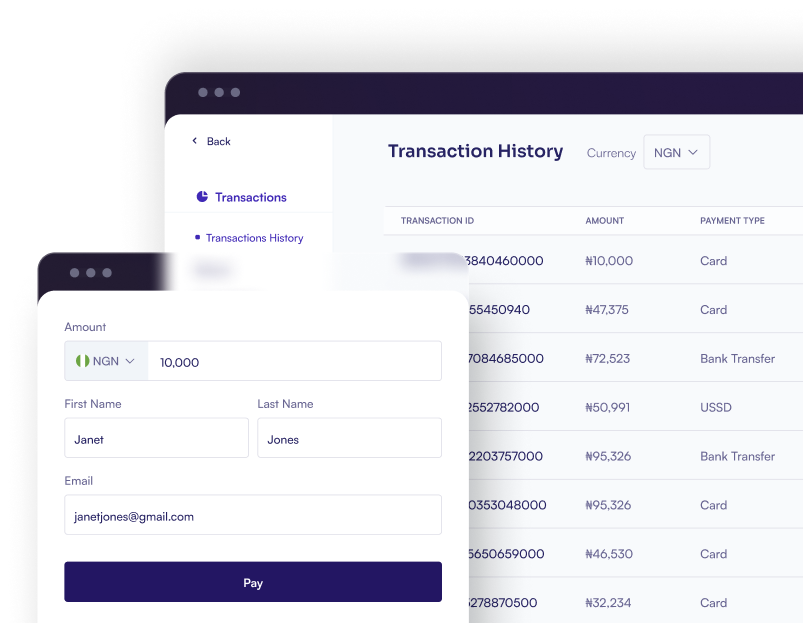

As part of the payment infrastructure powering fintech solutions, Bud Infrastructure Limited offers:

- Third-Party Transfer (TPT) support

- Merchant payment processing APIs

- Profile/account creation and fund disbursement engines

- Settlement, reconciliation, and reporting frameworks

- Direct bank integrations, including through partnerships with institutions like Parallex Bank

These services form the foundation of what many consumer-facing platforms and B2B fintechs use to go to market faster, with fewer compliance risks.

Is There a BudPay (Bud Infrastructure Limited) App?

Yes. You can download the Android and iOS app below.

If you’re a developer or fintech operator looking to integrate with Bud Infrastructure, access may be granted via API keys, SDKs, or client onboarding portals. View Documentations here

Bud Infrastructure Limited and Parallex Bank

Many searches connect Bud Infrastructure with Parallex Bank. While we won’t comment on specific commercial arrangements, it’s typical for a licensed PSSP to work with banking partners like Parallex to facilitate account validation, fund transfers, and NIP (NIBSS Instant Payment) routing for real-time payments.

This ensures end-users and merchants can move money confidently, powered by compliant APIs behind the scenes.

What Is TPT and Why Is It Important?

TPT stands for Third-Party Transfers. This is a regulated financial service that allows businesses or platforms to initiate fund transfers on behalf of their users or customers. Bud Infrastructure Limited’s TPT capabilities help bridge banks, wallets, and APIs, critical for fintech platforms to deliver seamless payment experiences.

If you’re building a platform that requires real-time transfers, TPT is the backbone functionality that ensures funds are routed properly between accounts.

Who Owns Bud Infrastructure Limited?

As a company operating in a regulated space, Bud Infrastructure Limited adheres to Nigeria’s compliance and corporate governance standards. Specific ownership details are typically filed with the Corporate Affairs Commission (CAC) and can be accessed by relevant authorities or stakeholders through official channels.

Salary Information: Working at Bud Infrastructure Limited

We’ve noticed growing search interest in:

- Bud Infrastructure Limited salary

- Bud Infrastructure Limited salary per month

While compensation varies based on experience and function, working with a licensed infrastructure provider typically involves roles in Business Development, Customer Success, Compliance, Finance, Product, Engineering, and more, where monthly salaries can vary depending on seniority and specialization.

Stay up to date with our latest openings on our Careers page.

FAQs About Bud Infrastructure Limited

Q1: Is Bud Infrastructure Limited a registered company in Nigeria?

Yes. It is a legally registered company and is licensed by the Central Bank of Nigeria as a Payment Solutions Service Provider (PSSP).

Q2: Is Bud Infrastructure Limited the same as BudPay?

No, but they are connected. BudPay is a subsidiary of Bud Infrastructure Limited.

Q3: Where can I find the Bud Infrastructure Limited website or app?

Because it’s an infrastructure provider, there’s no consumer-facing app at the moment. Access is usually available to approved partners or platforms.

Q4: What does Bud Infrastructure Limited mean by TPT?

TPT, or Third-Party Transfers, allows fintech platforms to send money between users, and banks securely and in compliance with CBN regulations.

Q5: How do I partner with Bud Infrastructure?

If you’re building a product and need PSP, or disbursement infrastructure, please reach out to us directly at hi@budpay.com

Conclusion: Why Bud Infrastructure Matters

At BudPay, we know that reliable infrastructure isn’t just “nice to have”, it’s the very foundation of every fintech experience that Nigerians rely on daily. So whether you’re sending money, collecting payments, or building something new, Bud Infrastructure Limited helps make that happen, quietly, securely, and compliantly.

For partnership or developer access to Bud Infrastructure services, reach out through our official email address – hi@budpay.com.