If you’re a Nigerian business owner weighing the vast potential of expanding into other African countries, you’re likely on the precipice of an exhilarating journey filled with opportunities and growth. However, as exciting as the prospect may be, it’s crucial to be aware of the challenges that may arise when taking your business beyond Nigerian borders.

In this blog post, we’ll examine five key challenges that Nigerian SMEs often face when pursuing international expansion within the African landscape. Understanding these hurdles is essential to effectively strategize and mitigate risks, ultimately paving the way for successful expansion initiatives.

1: Cultural Nuances and Market Dynamics

As you venture into new African markets, you’ll encounter a rich tapestry of cultures, traditions, and market dynamics that differ significantly from those in Nigeria. Understanding and adapting to these nuances is crucial for effectively positioning your products or services in the new market and resonating with local consumers. Language barriers, communication styles, and consumer behaviors vary across regions and can impact how your offerings are perceived. Successful expansion requires a deep appreciation and accommodation of these diverse cultural nuances, necessitating comprehensive market research and strategic localization efforts.

2: Regulatory Complexity and Compliance Hurdles

Navigating the regulatory and compliance landscape in African countries can be a labyrinthine ordeal for Nigerian SMEs looking to expand internationally. Each country comes with its own set of legal frameworks, tax structures, and trade regulations, which can pose significant hurdles to seamless business operations. From obtaining the requisite permits and licenses to adhering to local labor laws and trade policies, the complexity of regulatory compliance demands meticulous planning and expert guidance to ensure a smooth and legally sound expansion process.

3: Infrastructure and Logistics Bottlenecks

Infrastructure disparities and logistical challenges can pose formidable obstacles for Nigerian SMEs expanding into other African countries. From transportation networks and supply chain efficiency to warehousing facilities and distribution channels, deficiencies in infrastructure can impede the seamless flow of goods and services, hampering operational efficiency and impacting the overall customer experience. Addressing these bottlenecks demands strategic investments in building robust supply chain networks and forging partnerships with reliable local logistics providers to mitigate potential disruptions.

4: Financial Risks and Currency Volatility

The financial landscape in African markets is characterized by currency volatility, exchange rate fluctuations, and varied banking practices, posing inherent financial risks to Nigerian SMEs engaged in international expansion. This can manifest as challenges in managing cash flows, currency conversion costs, and exposure to economic instability. Mitigating these risks requires a comprehensive understanding of local financial ecosystems, access to reliable foreign exchange services, and the adoption of prudent financial management strategies tailored to the specific market dynamics of the target countries.

5: Customer Trust and Brand Localization

Establishing trust and credibility with local consumers in new African markets presents a significant challenge for Nigerian SMEs seeking international expansion. Overcoming the skepticism associated with foreign brands, understanding local preferences, and customizing your brand messaging to resonate with the aspirations and values of the target audience are crucial components of successful brand localization. Building trust and loyalty in a new market demands an astute understanding of consumer sentiment, localized marketing strategies, and a commitment to delivering products and services that align with the unique needs and expectations of the local customer base.

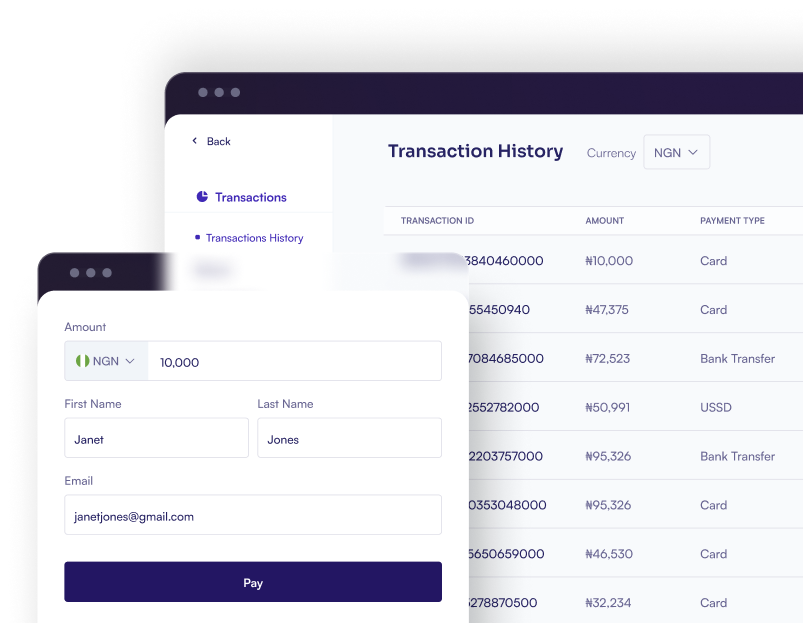

Seizing Expansion Opportunities with BudPay

As you navigate these challenges and set your sights on expanding your Nigerian SME into other African countries, partnering with the right financial services provider can make a world of difference. At BudPay, we understand the intricacies of international expansion and offer tailored cross-border payment solutions and local payment services in the top African markets. Our seamless and secure payment solutions are designed to empower businesses like yours to navigate the complexities of expansion while staying ahead of the financial curve.

As you embark on this transformative journey, remember, with the right partners and the determination to surmount the challenges, the opportunities that lie ahead are boundless. Let BudPay be your trusted partner in realizing your international expansion aspirations.