- What is Business Financing and Why Does it Matter?

- Financing Options in Nigeria and Africa

- Comparing Short-Term vs. Long-Term Financing

- Real-Life Examples: How African Businesses Raise Capital

- Challenges Businesses Face When Accessing Funding

- Practical Tips on Choosing the Right Financing Option

- Key Takeaways

Starting and growing a business in Nigeria and across Africa can be incredibly rewarding, but it often requires navigating the complex landscape of business financing. For Small and Medium Enterprises (SMEs) and startups, securing adequate capital is paramount for survival, growth, and achieving long-term sustainability. This complete guide breaks down the available options, challenges, and best practices for accessing funding to fuel your entrepreneurial dreams.

What is Business Financing and Why Does it Matter?

Business financing refers to the process of obtaining funds to support various business activities. This includes everything from starting a new venture to expanding existing operations, purchasing equipment, managing working capital, and fueling research and development.

For SMEs and startups, business financing is crucial for several reasons:

- Startup Capital: Initial funding is necessary to cover startup costs such as registration, equipment, and initial marketing.

- Growth and Expansion: Funding enables businesses to scale operations, enter new markets, and increase production capacity.

- Working Capital: Adequate financing ensures businesses can meet short-term obligations like paying suppliers and employees.

- Innovation and R&D: Funding facilitates the development of new products and services, allowing businesses to stay competitive.

- Surviving Economic Downturns: Access to financing provides a buffer during periods of economic uncertainty.

Financing Options in Nigeria and Africa

Understanding the diverse range of startup funding options is crucial for making informed decisions. Here are some of the most common avenues for securing SME financing in Nigeria and across Africa:

- Bank Loans: Traditional bank loans are a common source of funding, but often require collateral and a strong credit history, making them challenging for early-stage businesses. They can be useful for larger capital investments.

- Microfinance Institutions (MFIs): MFIs provide smaller loans to entrepreneurs, often with more flexible repayment terms than traditional banks. They are particularly helpful for businesses in the informal sector.

- Government-Backed Loans: The Nigerian government, through institutions like the Bank of Industry (BOI) and the Central Bank of Nigeria (CBN), offers various loan programs and interventions aimed at supporting SMEs. These loans often come with lower interest rates and longer repayment periods. Researching specific programs like the Agri-Business/Small and Medium Enterprises Investment Scheme (AGSMEIS) is crucial.

- Business Grants: Grants are non-repayable funds awarded to businesses based on specific criteria. They are often highly competitive but can be a significant boost to startups. Organizations like the Tony Elumelu Foundation offer grants to African entrepreneurs.

- Angel Investors: Angel investors are high-net-worth individuals who invest their personal funds in early-stage businesses in exchange for equity. They often provide mentorship and guidance alongside capital.

- Venture Capital (VC): Venture capital firms invest in high-growth potential startups in exchange for equity. They typically invest larger sums than angel investors and expect a significant return on their investment. Venture Capital investment in Africa has been on the rise in recent years.

- Crowdfunding: Crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms. This can be a viable option for businesses with a strong social impact or a unique product offering.

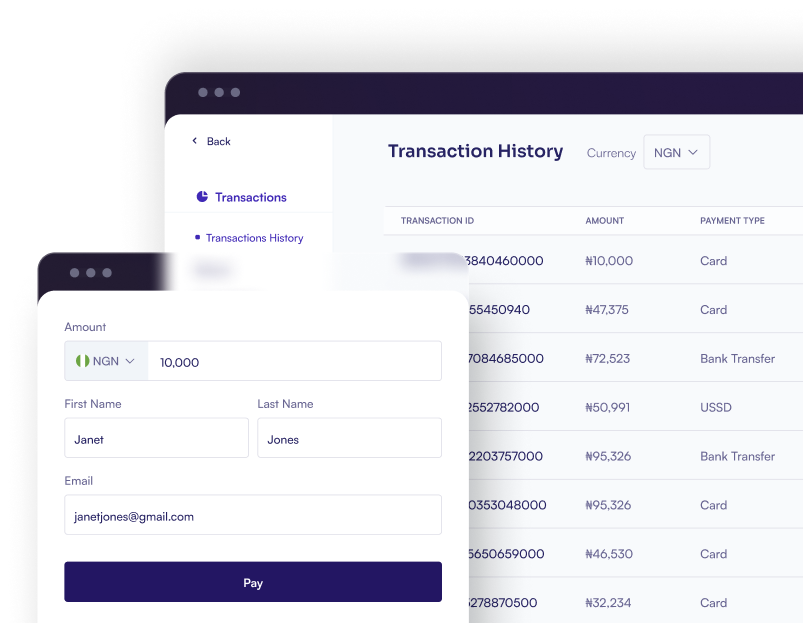

- Fintech Lending Platforms: A growing number of fintech companies are offering online lending solutions to SMEs, often with faster processing times and more flexible requirements than traditional banks. Examples include Lidya and Renmoney.

Comparing Short-Term vs. Long-Term Financing

Choosing between short-term and long-term financing depends on your business needs:

- Short-Term Financing: Used to cover immediate needs like working capital, inventory purchases, and short-term debts. Examples include lines of credit, invoice financing, and short-term loans.

- Long-Term Financing: Used for long-term investments like purchasing equipment, expanding facilities, and funding research and development. Examples include term loans, mortgages, and equity financing.

Real-Life Examples: How African Businesses Raise Capital

LifeBank (Nigeria): Solving Medical Supply Gaps with Technology and Logistics

LifeBank is a health-tech and logistics startup in Nigeria that helps hospitals access critical medical supplies such as blood, oxygen, and medical consumables.

Why It Worked: The company tackles a life-saving problem, medical supply shortages, using GPS technology, cold-chain logistics, and real-time delivery systems. Its strong social impact and scalable model across African cities made it highly attractive to investors and global health partners.

How They Raise Capital: LifeBank has secured funding from EchoVC, Google for Startups, the Africa Innovation Challenge, and the Tony Elumelu Foundation, combining grants, pitch competition wins, and seed-stage venture capital.

Twiga Foods (Kenya): Transforming Agriculture with Venture Capital and Debt Financing

Twiga Foods, a Kenyan B2B food distribution platform, has raised over $150 million through a combination of venture capital, private equity, and debt financing. The company connects farmers directly to vendors, eliminating middlemen and reducing food waste.

How They Raised Capital: Twiga attracted investors such as Goldman Sachs, IFC (International Finance Corporation), and Creadev by showcasing its ability to streamline the agricultural supply chain using technology and logistics infrastructure.

Why It Worked: A scalable solution to food distribution, strong supply chain technology, measurable impact on farmer income, and efficiency in urban food delivery made it highly attractive to global investors.

mPharma (Ghana): Improving Healthcare Access Through Venture Capital and Impact Investment

mPharma, a Ghanaian health-tech company, has raised over $80 million from venture capital firms and impact investors to create an affordable and reliable pharmaceutical supply chain across Africa. It partners with pharmacies and hospitals to manage prescription drug inventory and reduce medication costs.

How They Raised Capital: The company secured funding from investors such as Goldman Sachs, Novastar Ventures, CDC Group, and Breyer Capital. Their model of improving healthcare affordability and drug accessibility resonated with impact-driven investors.

Why It Worked: Clear social impact, data-driven inventory management, partnerships with healthcare providers, and expansion potential across multiple African countries positioned mPharma as a scalable and fundable venture.

These examples illustrate how different businesses leverage a combination of funding sources to achieve their growth objectives.

Challenges Businesses Face When Accessing Funding

Despite the availability of funding options, many businesses, especially early-stage ventures, face significant challenges:

- Lack of Collateral: Traditional banks often require collateral, which many SMEs do not possess.

- High Interest Rates: Interest rates on loans can be prohibitively high, especially for businesses considered high-risk.

- Stringent Requirements: Loan application processes can be lengthy and complex, with stringent documentation requirements.

- Limited Awareness: Many businesses are unaware of the various funding options available to them.

- Lack of Financial Literacy: Businesses may lack the financial literacy skills necessary to manage their finances and attract investors effectively.

Practical Tips on Choosing the Right Financing Option

- Assess Your Needs: Determine the specific amount of funding required and the purpose for which it will be used.

- Consider Your Repayment Ability: Ensure you can comfortably repay the loan based on your cash flow projections.

- Shop Around: Compare offers from different lenders to find the best terms and interest rates.

- Seek Professional Advice: Consult with a financial advisor to get expert guidance on the best financing option for your business.

- Prepare a Solid Business Plan: A well-written business plan is essential for attracting investors and securing loans.

Key Takeaways

Securing business loans in Africa and Nigeria requires a strategic approach. Understanding the available funding options, addressing the challenges, and carefully selecting the right financing partner are crucial steps toward building a successful and sustainable business. By exploring different avenues, from traditional bank loans to innovative fintech solutions, SMEs and startups can unlock the capital needed to drive growth and contribute to the economic development of the continent.