- Introduction

- Africa’s Growing Business Risk Gap

- The Legacy Crisis and the Businesses Breaking the Pattern

- Succession in the Digital Age

- Continuity is a Systems Problem

- Digital Transformation: The Missing Link in Succession Planning

- The Tough Side of Convincing Founders to Adopt Technology

- What Leaders Can Do Now

- A Better Legacy Is Possible

- Watch the video series here

Introduction

As Africa’s economy evolves, the resilience of its businesses must evolve too. A critical, yet often overlooked, challenge for Nigerian and African businesses is the high risk of failure after a founder or key leader leaves. According to the 2021 PwC Family Business Survey, only 16% of African family-owned businesses have a robust succession plan in place, despite contributing significantly to GDP and employment.

Our Legacy Project at BudPay uncovered a powerful truth: digital transformation is no longer a choice; it’s the foundation of a lasting business. Our research, which included interviews with founders, operators, and successors, reveals that building a sustainable company requires both talented people and robust digital systems. This article shares what we have learnt and challenges founders and leaders to rethink their legacy through a digital lens.

Africa’s Growing Business Risk Gap

While African businesses are known for grit and resourcefulness, their structures often lag behind their ambition. Many operate informally or with loosely defined systems, which leaves them exposed to disruption when leadership changes. Moreover, a report by the African Private Equity and Venture Capital Association (AVCA) notes that succession risk is a major deterrent for investors in founder-led businesses.

Despite the growing ecosystem of startups, SMEs, and family enterprises, there is a glaring gap: no continuity plan, no safety net. Going forward, the big question isn’t merely about who takes over, but what systems will they inherit, and are those systems built for scale?

The Legacy Crisis and the Businesses Breaking the Pattern

The Budpay Legacy Project was born out of a pressing question: What happens to African businesses when their founders step aside? Across the continent, a common and concerning trend is the uncertainty faced by businesses. With vague or nonexistent succession plans, companies often falter, and vital institutional knowledge vanishes when a founder leaves.

But The Legacy Project set out to tell a different story.

We profiled forward-thinking businesses whose founders have either fully or partially handed over leadership, often to family members or professional managers, and are navigating continuity with intention. These businesses are not perfect, but they are doing the hard work: documenting operations, digitizing financial systems, and embedding a culture of transparency.

In a landscape where legacy often feels fragile, these leaders offer a blueprint for what’s possible. They are challenging the norm and proving that continuity is achievable when built on systems, not sentiment. Their stories are not just inspiring; they are instructive for the thousands of African businesses yet to cross this critical threshold.

Succession in the Digital Age

Today’s successors, unlike their older counterparts, are not sitting around waiting for transitions to happen; they are instead building their playbooks. Many are digital natives, fluent in tools that enhance productivity, customer engagement, and financial transparency. Yet, they’re often stepping into businesses that are still using handwritten ledgers and WhatsApp as their primary CRM.

This creates friction. Most founders resist change as successors push for modernization, but where there’s no structured digital foundation, successors spend their first few years cleaning up, not scaling up.

Continuity is a Systems Problem

Succession planning is often mistaken as a people issue, choosing the “right person” to lead. But the real challenge is operational. Business continuity demands:

● Real-time access to records

● Centralized data management

● Financial accountability

● Automated workflows

● Documented SOPs

When none of these exist, the next leader isn’t stepping into a business; they’re stepping into chaos.

BudPay has observed this firsthand. Many of our SME clients who survived founder transitions did so because they digitized key parts of their business, inventory, payments, receivables, and customer data long before change came.

Digital Transformation: The Missing Link in Succession Planning

Digital transformation ensures that processes don’t collapse when people move on. It creates audit trails, simplifies onboarding, and democratizes access to institutional knowledge.

Here are some practical examples:

● Finance: Digitally reconciled payments and dashboards give instant visibility into business health.

● Operations: Cloud-based task systems ensure continuity across departments.

● Sales & CRM: Platforms like Zoho or Salesforce capture leads, contacts, and deal history.

As one of our Legacy Project participants, a second-generation CEO, said, “When my dad retired, we spent a considerable amount of time switching from analog systems. Now, everything is digital and backed up. I can travel for two months, and the business won’t miss a beat.”

The Tough Side of Convincing Founders to Adopt Technology

One of the most consistent tensions we observed during The Legacy Project is the challenge of getting founders, especially first-generation business owners, to embrace technology as a core part of continuity.

In many African businesses, legacy is deeply personal. Founders often built their companies from scratch, relying on intuition, relationships, and informal systems. For them, handing over control is already difficult. Digitizing those processes feels like an even bigger leap, one that can appear to undermine the human trust and instinct that built the business in the first place.

There are also generational and cultural dynamics at play. Traditional hierarchies often place more weight on experience than innovation. Suggestions to automate or introduce new platforms are sometimes seen as disrespectful or disruptive, especially when coming from younger team members or external professionals.

Yet, what we found inspiring in The Legacy Project was the businesses where that mindset is slowly changing. Successors, many of them women and Gen Z leaders, are introducing tech not just for efficiency, but to preserve and scale what the founder built. Through tools like cloud accounting, digital approvals, automated reporting, and integrated payments, they’re ensuring that legacy doesn’t disappear with the founder; it evolves beyond them.

These transitions aren’t always smooth. But they show that technology, when introduced with care and strategic value, can bridge generations and secure the future of a business.

What Leaders Can Do Now

These are a few key steps any founder or business leader can initiate towards leaving a worthwhile legacy through business succession and continuity:

● Start a continuity file: Establish a centralized, secure repository to house critical business information. This includes creating a master list of all passwords and access credentials, compiling a comprehensive directory of key contacts (clients, suppliers, legal counsel), organizing all legal and financial documents, and maintaining detailed records of all vendor agreements and service contracts. This ensures that essential information is readily accessible to authorized personnel, minimizing disruption during a leadership transition or an emergency.

● Document SOPs: Develop detailed, step-by-step Standard Operating Procedures (SOPs) for all key business functions. These living guides should cover everything from the client onboarding process and daily operational tasks to financial procedures like payroll and expense reporting. By creating a standardized, documented process for every aspect of the business, you ensure that operations remain consistent and efficient, even as new team members take on different roles.

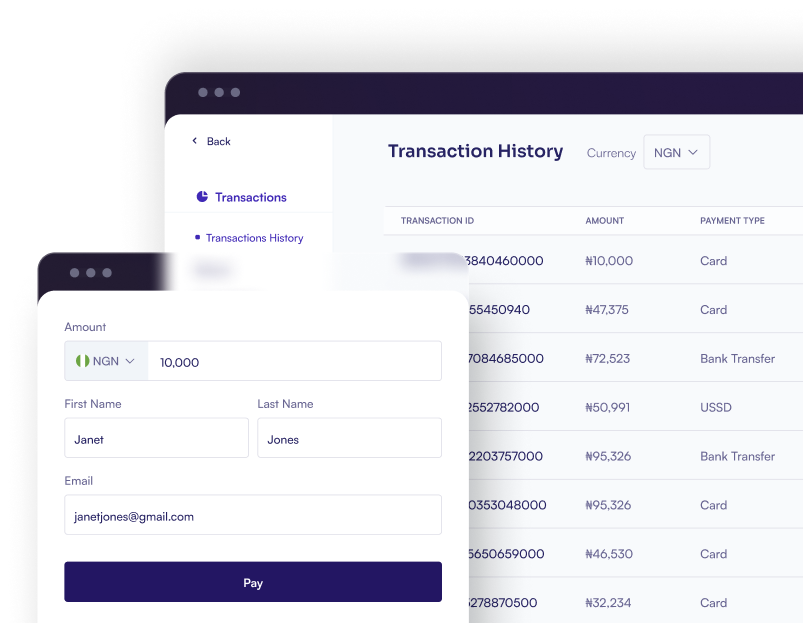

● Adopt fintech tools: Integrate modern financial technology platforms, such as BudPay, into your business operations. These tools can automate the management of business payments, expenses, and merchant records. Leveraging these platforms can help create a system of accountability and transparency, making it easier to track financial activities, manage budgets, and maintain a clear audit trail for a smooth transition in financial oversight.

● Manage change strategically: Use a structured approach to align stakeholders, minimize resistance, and facilitate acceptance of new digital initiatives to ensure a smooth transition in leadership while embracing innovation and maintaining operational continuity.

● Mentor successors: Go beyond traditional leadership training by mentoring successors in systems thinking. This approach involves teaching them to understand the interconnectedness of different business functions, how to identify bottlenecks, and how to improve overall operational efficiency. If properly done, this can foster a deep understanding of the entire business ecosystem, thus preparing future leaders to both manage people and to strategically optimize processes and ensure the long-term health and stability of the business.

A Better Legacy Is Possible

The future of business in Africa is digital, structured, and scalable. Succession isn’t a handover of power; it’s a handover of systems. It’s a consolation to see leaders who are embracing this now, as this not only future-proofs their businesses, but their legacies.

The Legacy Project is BudPay’s contribution to this important conversation. We invite founders, successors, and the media to join us in reshaping what legacy means for African businesses.

Watch the video series here

By Angela Obilom, Content Marketing Lead at BudPay | Curator of The Legacy Project