In a global economy where SMEs create 7 out of 10 jobs and contribute up to 40% of GDP in emerging markets, a startling $4.3 billion is lost annually to cross-border transaction fees in Africa alone. With estimates showing that 600 million new jobs will be needed by 2030 to absorb the growing global workforce, why are we still allowing outdated payment systems to hold back the engines of economic growth?

This financial burden is particularly crushing in Africa’s emerging markets, where SMEs represent 90% of all businesses and drive more than 50% of employment. While access to finance already ranks as the second most significant obstacle for SME growth in developing countries, the additional weight of excessive cross-border payment fees creates an almost insurmountable barrier to international expansion. With 40% of payments between East and West Africa still conducted in cash, and settlement periods stretching beyond a week, the continent’s small businesses operate in a system designed for their failure rather than their success.

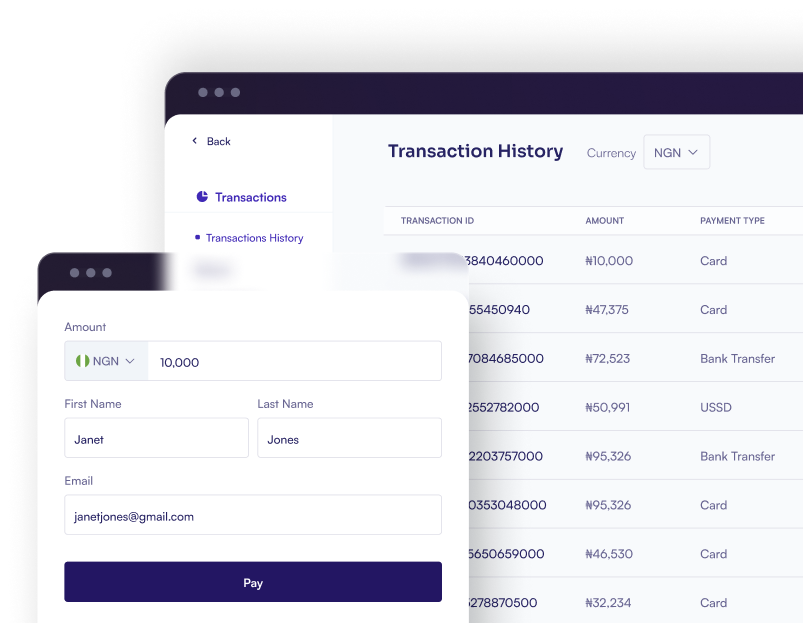

At a recent webinar focused on “The Future of Cross-Border Payments in Africa,” Chijioke Ngwamba, Senior Growth and Partnership Lead at BudPay, highlighted the transformative power of payment innovation. “Digital payment innovation isn’t just about moving money faster—it’s about democratizing access to global trade,” says Ngwamba, “When we reduced transaction fees from 10% to 1%, we weren’t just cutting costs. We were opening doors for thousands of businesses who previously couldn’t afford to think beyond their local markets.”

Real businesses are seeing real results. Consider the transformation in East Africa, where digital payment adoption has cut transaction times from weeks to minutes. Small businesses that previously spent up to 12% of their revenue on international payment fees now allocate those funds to growth and expansion. This efficiency gain is crucial as Africa moves toward implementing the African Continental Free Trade Area (AfCFTA), which promises to create a $6.7 trillion economic opportunity by 2030.

“Looking ahead to 2025,” Ngwamba shared, “we anticipate significant shifts in the payment ecosystem. We’ll see more payment providers entering the market, bringing healthy competition and more options for end users. More importantly, we expect regulatory frameworks to formally recognize digital currencies as payment options for cross-border transactions, making payments even faster and more affordable.”

The Pan-African Payment and Settlement System (PAPSS) represents the next frontier, with projections suggesting it will save the continent $5 billion annually in transaction costs. This system, combined with emerging fintech solutions, is creating an unprecedented opportunity for African businesses to scale globally.

“Strategic partnerships are crucial in this evolution,” Ngwamba emphasized. “Our collaboration with Klasha, for instance, has created a framework that eliminates the need for small businesses to establish local accounts in each market. This is how we’re making cross-border trade accessible to everyone, not just large corporations.”

For businesses looking to capitalize on these changes, Ngwamba outlined several key strategies:

• Focus on building robust digital infrastructure

• Prioritize customer and user experiences

• Stay adaptable to regulatory changes

• Build strong partnerships within the payment ecosystem

• Leverage data analytics for informed decision-making

“The infrastructure is ready, the technology is proven, and the market opportunity is clear,” concluded Ngwamba. “For African businesses, this isn’t just about keeping up—it’s about leading the way in global commerce.”

This transformation comes at a crucial moment for African commerce. With McKinsey projecting transaction volumes to reach 188 billion by 2025, platforms like BudPay are ensuring that businesses of all sizes can participate in this digital revolution. The future of African trade is digital, and it’s unfolding now.