- How to Check Spotify Wrapped 2025

- Using the Mobile App (iOS and Android)

- Using the Web (Desktop or Mobile)

- If You Still Can’t Access Wrapped

- Your Numbers Tell a Story When You Track Them Properly

- Clear Insights Reduce Compliance Stress

- Digital Records are now more essential than ever

- Predictive Insights Help Businesses Stay Ahead

- How BudPay Helps Businesses Prepare for Tax Reforms

- Your Business Needs Its Own Version of Wrapped

Every December, our timelines floods with shares of Spotify Wrapped. People are curious to discover their top artists, songs, and listening habits. If you’re wondering how to check Spotify Wrapped, it’s usually available in the Spotify app in late November or early December. Use the steps below to check it out.

How to Check Spotify Wrapped 2025

Using the Mobile App (iOS and Android)

- Make sure you have the latest version of the Spotify app installed.

- Open the app and look for the “Your 2025 Wrapped” banner. Once you tap the banner, your Unwrapped opens up.

- If the banner is not visible, use the Wrapped tab at the top of the Home screen.

- Search for Wrapped: You can also search for Wrapped through the search bar.

Using the Web (Desktop or Mobile)

- Go to spotify.com/wrapped and sign in. Once you’re in, you’ll find the Wrapped banner displayed.

- The desktop app does not support the full slideshow. Use the mobile app or a browser for the complete experience.

If You Still Can’t Access Wrapped

- Ensure your account has enough listening activity. Spotify requires at least 30 tracks played for over 30 seconds each, across five or more artists, within the year’s tracking period.

- Refresh the app: Clearing the cache or reinstalling the app can make Wrapped appear.

- Finding past Wrapped playlists: Your older “Top Songs” playlists remain available. Search for “Your Top Songs [Year]” (for example, “Your Top Songs 2024”) to view them.

Now back to tax matters.

Spotify Wrapped is both a fun year-end summary and a powerful example of how clear, well-organized data can provide valuable insights. And that’s a lesson Nigerian businesses can apply to the new tax reforms. While these reforms introduce new rules and obligations, the biggest challenge for many businesses is achieving clarity around their finances.

Let’s explore how the principles behind Spotify Wrapped – clear data, organized insights, and consistent tracking – can help businesses prepare for tax reforms and set up better systems for financial visibility and compliance in Nigeria.

Your Numbers Tell a Story When You Track Them Properly

Spotify Wrapped works because Spotify captures every stream, skip, playlist addition, and listening habit. It builds an entire yearly report from small pieces of data collected consistently. Many businesses experience the opposite. Records are kept in fragments. Payments are not coordinated. Cash transactions go unrecorded. Spreadsheets are updated irregularly.

The new tax reforms demand a cleaner approach. Your businesses need systems that keep a continuous record of:

- Revenue from all channels

- Discounts and deductions

- Customer payment timelines

- Business expenses

- Payout delays or reversals

Without this data, it becomes difficult to file tax returns, reconcile accounts, or prove compliance when regulators request it. Like Spotify Wrapped, the quality of the final output depends on the quality of the data captured throughout the year.

Clear Insights Reduce Compliance Stress

Spotify Wrapped doesn’t overwhelm you with thousands of data points. Instead, it gives you concise highlights. It shows your top artists, your most-played songs, and the minutes you listened. In the same way, businesses need financial information presented in a simple, digestible format. The new tax reforms come with implications for VAT, PAYE, corporate tax, and reporting requirements that can seem complex at first glance.

Your business benefits when financial data is presented as:

- Monthly revenue summaries

- Tax-impact snapshots

- Reconciliation overviews

- Customer behavior patterns

Clear insight reduces errors, simplifies reporting, and helps business owners understand how the reforms affect them. When information is visual and structured, it is easier to make sense of complex policies.

Digital Records are now more essential than ever

Spotify Wrapped exists because digital systems make record tracking automatic. Every action is captured. Nigeria’s tax reforms are moving in a similar direction. Digital receipts, electronic invoicing, reliable payment logs, and transparent financial trails are becoming important for tax compliance. Businesses that still rely heavily on cash or manual records risk falling behind or facing audit complications.

Businesses need dependable digital systems for:

- Transaction tracking

- Electronic receipts

- Invoice generation

- Payment verification

- Audit-friendly reports

This is no longer just good practice. It supports compliance and reduces the risks that come with manual errors.

Predictive Insights Help Businesses Stay Ahead

One subtle feature of Spotify Wrapped is how it hints at your listening personality. It uses patterns to predict what you might enjoy. For businesses, patterns in payment data can do the same. They reveal seasonal trends, customer behavior, common revenue dips, and areas of tax exposure.

With predictive insights, you can anticipate:

- Slow months

- Peak sales periods

- Potential tax liabilities

- Opportunities to adjust prices or incentives

- Operational risks from delayed payments

When you understand the patterns in your business early, you’re able to act faster, stay compliant, and plan far more effectively.

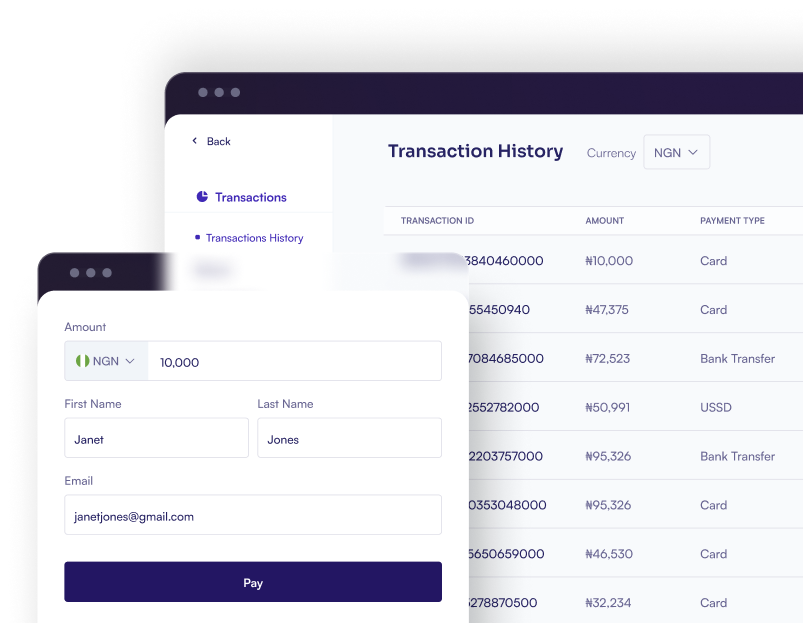

How BudPay Helps Businesses Prepare for Tax Reforms

BudPay supports businesses with infrastructure that strengthens financial visibility and simplifies compliance. Our platform makes it easier to track digital payments, remove reconciliation errors, and generate the kind of clean, structured data that tax reforms now require.

Key BudPay features that support compliance include:

- Clear transaction histories across all channels

- Automated reconciliation

- Downloadable statements for filings

- Real-time insights on collections and payouts

- Digital records designed for audit readiness

When you use BudPay’s dashboard consistently as a business, you get the equivalent of a financial Wrapped report. Their transaction history becomes a story of how your business performed, where the revenue came from, and how prepared you are for regulatory changes.

If you’re business looking to understand the new tax laws more and how to be better prepared, click here to learn how BudPay can help.

Your Business Needs Its Own Version of Wrapped

Spotify Wrapped shows us that data becomes powerful when it is collected, organized, and presented clearly. As Nigerian businesses navigate the new tax reforms, the same principle applies. Strong digital records lead to clear insights. Clear insights lead to easier compliance. Payment platforms that support transparency make the process even smoother.

The lessons are simple. Track your numbers well. Use tools that present information clearly. Stay consistent. With the right systems in place, navigating Nigeria’s tax reforms becomes far easier than it seems.