- Introduction

- Major Business Taxes in Nigeria

- 1. Company Income Tax (CIT)

- 2. Personal Income Tax (PIT)

- 3. Value Added Tax (VAT)

- 4. Capital Gains Tax (CGT)

- 5. Business Premises Tax (BPT)

- 6. Custom Duties

- 7. Stamp Duty

- Which Authorities Are Legally Allowed to Collect Taxes in Nigeria?

- Federal Level: Federal Inland Revenue Service (FIRS)

- State Level: State Inland Revenue Service (SIRS), E.g. LIRS for Lagos State

- Local Level: Local Government Revenue Committees (LGRCs)

- Tax Compliance Requirements

- Step-by-Step Tax Payment Process

- Business Tax Best Practices

- (Read more: Smart Tax-Saving Strategies for Businesses)

- When to Invest in Professional Help:

Introduction

All businesses in Nigeria, regardless of size, must pay taxes to the government. As a business owner in Nigeria, understanding your tax obligations doesn’t have to be overwhelming. This practical guide breaks down exactly what you need to know to keep your business tax-compliant without getting lost in complex regulations.

Why is it important to understand and remit taxes on time? This is because failing to comply can result in severe penalties, including hefty fines, reputational damage, or business closure.

Major Business Taxes in Nigeria

The list below contains the main taxes required of small and medium-scale businesses in Nigeria. Bear in mind that new regulations could spring up that may increase or reduce the list.

1. Company Income Tax (CIT)

Rates vary based on annual turnover:

- Below ₦25 million: Tax exempt

- ₦25-100 million: 20%

- Above ₦100 million: 30%

Companies must file returns within six months of their financial year-end. Late payment incurs a ₦25,000 fine for the first month and ₦5,000 for each subsequent month.

2. Personal Income Tax (PIT)

Business owners must pay PIT on profits and handle PAYE deductions for employees. Rates range from 7% to 24% based on income brackets. PAYE remittance is due by the 10th of each month.

3. Value Added Tax (VAT)

Current rate: 7.5%

- This applies to most goods and services

- Exemptions include basic food items, medical products, educational materials, and agricultural products

- Late payment penalties: 5% per annum plus interest

- Non-registration penalties: ₦10,000 first month, ₦5,000 subsequent months

4. Capital Gains Tax (CGT)

- Rate: 10%

- Applies to profits from selling capital assets

- Covers land, buildings, stocks, and shares

5. Business Premises Tax (BPT)

Rates vary by location:

- Urban areas: ₦10,000 registration, ₦5,000 renewal

- Rural areas: ₦2,000 flat rate

6. Custom Duties

- Rates: 5-35%

- Based on the Harmonized Commodity and Coding System

- Varies by import type

7. Stamp Duty

- This applies to legal document transfers

- Must be stamped within 40 days

- Rates vary between fixed and ad valorem

Which Authorities Are Legally Allowed to Collect Taxes in Nigeria?

Now that we’ve seen the list of taxes, it’s important to outline the authorized to receive taxes. All three tiers of government are tasked with revenue collection. They all also have the types of taxes they’ve been assigned to collect.

Federal Level: Federal Inland Revenue Service (FIRS)

The FIRS handles federal taxes including Company Income Tax (CIT), Value Added Tax (VAT), Capital Gains Tax, and Stamp Duty Tax.

State Level: State Inland Revenue Service (SIRS), E.g. LIRS for Lagos State

Each state maintains its own revenue service responsible for collecting Personal Income Tax, Business Premises Tax, and Development Levies. For example, Lagos State operates through the Lagos State Internal Revenue Service (LIRS).

Local Level: Local Government Revenue Committees (LGRCs)

These committees manage local taxes and fees including:

- Shop and kiosk rates

- Street registration fees

- Rural land occupancy fees

- Motor park levies

- Merriment and road closure charges

- Public convenience and waste management fees

Tax Compliance Requirements

Essential documentation includes:

- Tax Identification Number (TIN)

- Audited Financial Statements

- Completed Self-Assessment Forms

- Supporting documentation for specific taxes

Step-by-Step Tax Payment Process

- Business Registration

- Register with FIRS and state tax authority

- Provide business details and documentation

- Tax Assessment

- Identify applicable taxes

- Track expenses and profits

- Calculate taxable income

- Self-Assessment

- Complete required forms

- Estimate annual tax liability

- Filing Returns

- Gather necessary documentation

- Submit through appropriate online portal

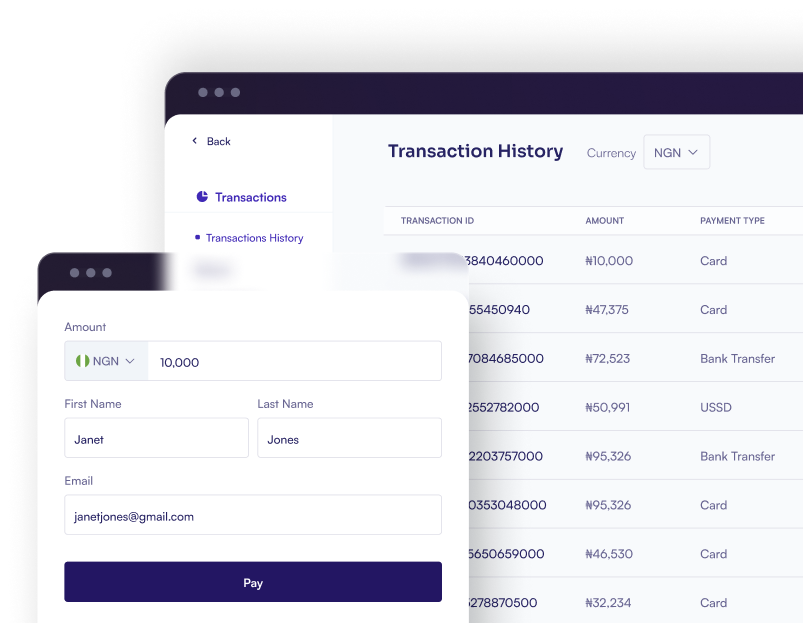

- Payment

- Pay via bank or online platforms

- Keep TIN and documentation accessible

- Record Keeping

- Maintain records for a minimum 6 years

- Store receipts, statements, and returns

- Prepare for potential audits

Business Tax Best Practices

- Maintain organized financial records

- Set tax payment reminders

- Utilize available tax authority resources

- Consider professional tax assistance when needed

- Stay informed about tax law changes

(Read more: Smart Tax-Saving Strategies for Businesses)

When to Invest in Professional Help:

- Annual tax filing if you’re growing

- Setting up accounting systems

- Planning for expansion

- Handling tax disputes

Remember: Good tax compliance helps your business grow and avoid problems later!