At the Aviation Africa Summit 2024 in South Africa, we sat down with four aviation experts from various parts of Africa for a brief chat on the current state of payment infrastructure and how it affects organisations like theirs.

Here’s a short recap of their feedback and insights.

Charles Sasi, Commercial Director of Safe Air, Kenya

Currency Conversion: The multitude of currencies across Africa poses a significant challenge for aviation businesses. Converting local currencies to international markets creates friction in transactions.

Sasi also cited how the aviation industry is showing signs of recovery following the COVID-19 pandemic. Face-to-face meetings are resuming and business activity is increasing.

Ruth Kukunda, Head of African Development, NAVPASS

Payment Technology as Empowerment of Sustainable Development: NavPass utilizes technology to bridge the divide between developed and developing nations, specifically in Africa, by empowering governments to effectively collect aviation fees. The efficient collection of these overflight fees, which is a core aspect of civil aviation, is crucial for national development.

NavPass focuses on empowering African nations to achieve their potential in the aviation sector.

Data-Driven Future: Ruth emphasized that data collection and analysis highlight the growing importance of technology in driving progress and informed decision-making.

Emmanuel Aka, Marketing Manager of Ivory Jet Services,

The business of the aviation industry operates on a pre-flight payment model, requiring customers to pay for their charter before departure. For this reason, payment systems for the sector must be effective

Challenges with international payments: Emmanuel stressed the difficulties Jet Services faces in receiving instant payments from customers located in various other African countries. This is a significant obstacle given the international nature of their clientele.

Limited payment options: The current payment infrastructure in Africa lacks the capability to facilitate instant cross-border transactions efficiently. This limitation hampers the ability of aviation businesses to receive payments in real time from customers in different countries.

Anointing Umoh, Chief Operating Officer, Allocentric Travels and Tours

Challenges with International Payments: The most significant challenge as highlighted by Umoh is the difficulty of processing international payments in the travel industry.

Managing Client Expectations Post-Payment: Clients often demand immediate action upon payment, even when paying from foreign accounts. This suggests a need for more efficient and seamless cross-border payment solutions within the industry.

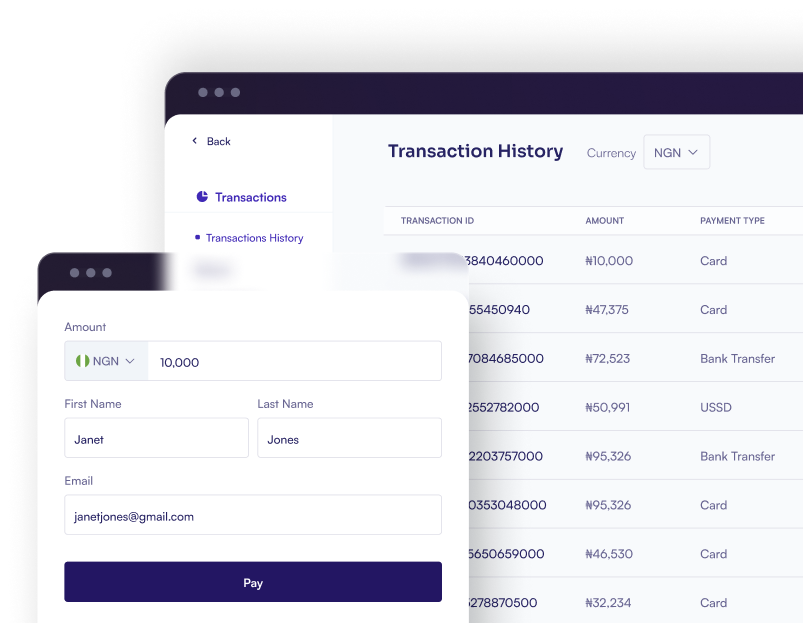

In closing, these insights correspond to the driving force behind what we do at BudPay, which is to ensure that key sectors of the economy like aviation do not lose out on vital revenue due to inefficiencies in payment collection.

We’re excited about the ongoing adoption of alternative payment methods within the aviation industry and look forward to more organisations coming on board.