As Africa’s financial landscape evolves, finance leaders must stay ahead of emerging trends to navigate economic shifts and seize new opportunities. From digital transformation to regulatory changes, understanding these trends can help businesses and financial institutions remain competitive in 2025. Here are three key trends finance professionals in African markets should pay close attention to.

1. The Rise of Digital and Decentralized Finance

Financial technology (fintech) continues to redefine banking and payments across Africa. Mobile money, blockchain-based transactions, and decentralized finance (DeFi) solutions are becoming more prominent.

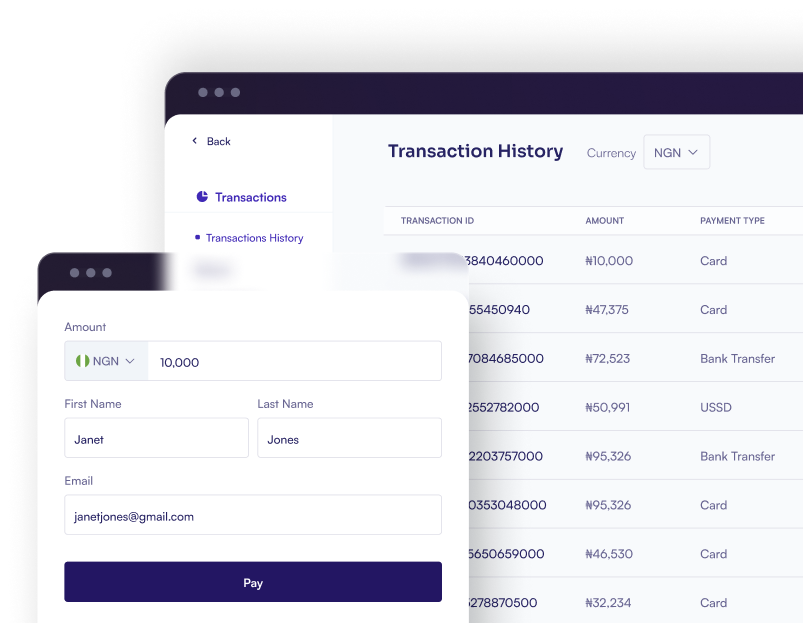

The widespread adoption of mobile money services like M-Pesa and digital payment platforms like BudPay has improved financial transactions across Africa.

Finance leaders should explore partnerships with fintech firms and consider integrating digital payment options to enhance accessibility and efficiency.

2. Regulatory Changes and Compliance Demands

African financial markets are seeing increased regulatory oversight as governments work to strengthen financial stability and protect consumers. New regulations around data protection, digital banking, and taxation are emerging. Nigeria’s recent regulations on fintech licensing have impacted how startups operate, making compliance a crucial consideration for growth.

Stay updated on regulatory changes in your country, consult compliance experts, and ensure financial operations align with the latest legal frameworks.

3. The Growth of Green Finance and Sustainable Investments

Sustainability is becoming a priority for investors, with increasing demand for green bonds, impact investments, and climate-conscious financial solutions.

African banks and investment firms are financing renewable energy projects, supporting eco-friendly startups, and encouraging responsible lending.

Consider sustainable investment strategies and assess ESG (Environmental, Social, and Governance) factors when making financial decisions.

Ready to modernize your financial operations? Explore BudPay’s digital payment solutions to enhance efficiency and compliance.